Insurance Telematics: An Opportunity in the Wings

For any industry, the adoption of new technologies, notably when these technologies disrupt the existing business models, can be a real challenge leading to an impasse. It is a dare that stakeholders in motor Insurance in India, are facing today; how to move progressively and adopt the emerging new business model. Fast-paced developments in telematics and software have ensured that a staggering amount of data is collected from a vehicle integrated with these technologies. This has opened the avenue for the usage of this data for effective cost optimization and developing new business models. The case in point here is the emerging trend of Usage-based Insurance in the automotive industry.

Telematics-supported Usage-Based Insurance (UBI) programs are gaining traction and acceptance in the global motor insurance industry. These programs benefit both insurers and consumers by providing data for beer risk assessment, as well as incentive-based, “pay-as-you-drive” (PAYD) programs. Insurance companies are leveraging telematics data to extract more information about the way a vehicle is being driven to offer more personalized services to customers in a cost-effective manner. This is the reason why it can be attractive to both insurers and policyholders.

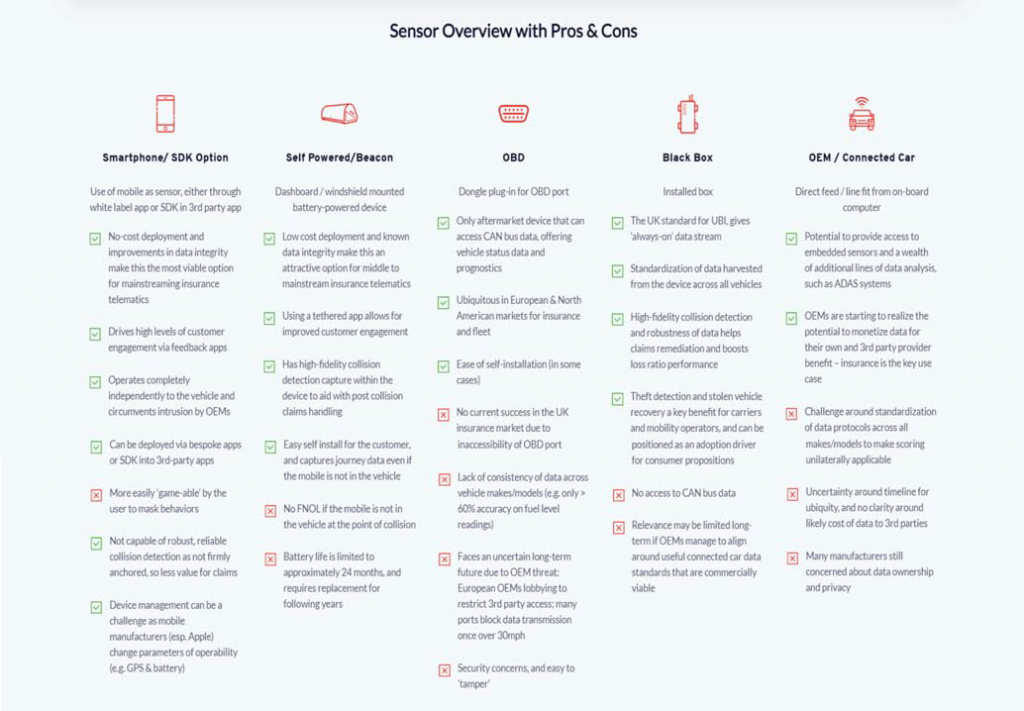

UBI uses embedded devices or smartphones to draw data based on the driver behavior such as driving times, parking locations, standard of driving, vehicle, and mileage data and various aspects of driving. Insurers are taking advantage of this data to get deeper insights into customers’ driving habits that in turn helps in optimum premium calculation. With the rapid developments in sensor technologies, there are a number of options to collect driving data. A sensor overview with pros and cons are given here (fig. 1); Courtesy Insurance and Mobility Solutions. (Disclaimer: we do not accept any responsibility for inferences drawn from this sensor overview or its authenticity)

All the stakeholders will have to play a very significant role for the insurance industry in India to move progressively towards UBI business models, and be amongst leading nations to usher in a newer version of insurance in sync with the aspirations of Digital India.

Among the stakeholders in the Indian Insurance space, the regulator, IRDAI plays a critical role. Obvious! If one cares to read the mission statement of IRDAI, the supreme regulatory body is fundamentally oriented towards consumer protection and enabling growth of the insurance industry. To that extent, one can really applaud various policy reforms and mentoring/monitoring by IRDAI. Having said that, it is also a fact that the regulator, in the past, had not been able to bring about much flexibility in its approach towards emerging technologies which would ultimately decide on the future form and format of insurance in India. This was the story up to the year 2016.

Journey of UBI in India so far:

Come year 2017 and we saw a change in the approach of IRDAI towards technologies that are bringing more fairness, transparency, and accuracy for an insurer arriving at the premium for underwriting the motor insurance cover.

First time in 2017, IRDAI officially talked about bonanza, which is insurance telematics or the black box insurance or whatever you may like to refer to this phenomenon as had to offer. Discussion paper acknowledged that today ‘Telematics’ is “a much talked about concept as it enables a more scientific methodology for pricing, apart from having certain advantages for the insured, insurer and the society as a whole.”

It was a maiden attempt by IRDAI to look into the role telematics could play in Motor insurance as evident from the title “DISCUSSION PAPER- Telematics and Motor Insurance.” Though it was elementary and simply talked about things well known which were already being implemented in most of the developed countries; still going by our penchant for being late risers to the emerging technologies which could bring new opportunities on the horizon, this attempt could be categorized as one of those, better late than never.

The Telematics Industry was really thrilled if one was to go by the enthusiastic and positive response Telematics Wire received when it organized a few workshops on this most promising development and a not-so-late initiative by IRDAI in the field of motor insurance. A move with reasonable pace and clarity by the policymakers and insurers would create a domino effect to bring lots of positive gains in many other areas in the automotive industry

One could have expected things to move fast and at the very least IRDAI could have identified the other stakeholders which could be benefitted/involved by the advent of telematics-based insurance products going in the market. It is not known if stakeholders like Telematics Service Providers who would be front runners for offering customized devices to insurers to administer and manage UBI policies were made part of any think tank if constituted by IRDAI in the follow-up run after this discussion paper. Another extremely significant stakeholder group, in the periphery of the insurance industry and consumers, could be the organizations working in the domain of road safety. It is an established fact that with sustained public awareness of the advantages of products like ‘Pay how you drive’ have a better chance of adoption by consumers and in turn on reducing the accidents.

Alas! IRDAI was tight-lipped about what they were planning or thinking as a way forward and one did not find any further movement for the next one year or so going by the IRDAI website announcements/disclosures. Seems IRDAI was working silently and in their own silo (No offenses meant, this is far too common a phenomenon both in industry and in Government departments).

Some of the Motor insurers reportedly offered the option to customers, on an experimental basis, for PAUD (Pay As You Drive) or PHUD (Pay How You Drive) type of insurance policies for vehicle insurance. These experimental offers came out somewhere during the period 2016 to 2020. According to the online insurance portal, www.policybazar.com IRDAI approved a number of Insurers to offer Telematics based Motor Insurance products under a sandbox project on an experimental basis. Presumably, this approval was one year or so till January 2021.

According to Policy Bazar in this sandbox project, the policy tenure was only for one year. While IRDAI decided the Third Party premium, the own damage premium was based on car usage slab as per Km covered. The car usage slabs were decided by and could vary from one insurer to another. Interestingly the telematics device was to be provided by the insurer free of cost.

There are about 25 public and private general insurance companies that are offering Motor insurance. If one searches Google (of course IRDAI does not disclose this on their website) with the list of Motor Insurance Companies That offer Pay as You Drive type motor insurance, some of the names that appear in various searches are (fig: 2):

ICICI Lombard had also started offering telematics-based products like ‘pay as you use’ and ‘pay how you use’ in 2020 with a Disclaimer: Pay How You Use (PHYU) (Sandbox application no.173) is offered as an experiment under the Regulatory Sandbox proposal valid from 1st February 2020 to 31st January 2021 (https://www.icicilombard.com/motor-insurance/pay-how-you-drive.). In a recent contact, it was learned that presently none of these products are on offer through ICICI Lombard has retained these products in their portal.

According to an informal and unverified input similar fate occurred with Bajaj Allianz which had offered telematics-based insurance motor cover in 2020. Whether it was an unviable loss-making product or any other related compliance issue, as of 2021 Bajaj Allianz has discontinued this product.

According to policy Bazar in the first tranche of sanctions, IRDAI had approved many companies but not everybody came out with the UBI policies. Some of the companies offered policies based on the maximum kilometer run option for the policy. While making the purchase, the customer was required to choose the maximum kilometer coverage one wanted to opt for. Say If you don’t take your vehicle out much, you can opt for lower coverage. Of course, you have the option of topping up your coverage – by buying an additional number of kilometers if you feel you will exceed your existing coverage. But the Third-Party insurance cover, which is compulsory, will be valid throughout the policy period irrespective of the kilometers declared by the customer.

In their sandbox project, IRDAI allowed Motor insurers to offer telematics-based insurance products as a regular product but the companies were to clock ten thousand policies within six months before they could sell these products as a regular motor insurance product (https://www.policybazaar.com/motor-insurance/car-insurance/pay-as-you-drive-insurance/?pb_source=organic.).

According to the TATA AIG press release, published in The Economics Times| Wealth, English Edition | E-Paper on June 4, 2020, the telematics device or app is fitted or linked to the policyholder’s car as the motor insurance policy becomes active and must be kept throughout the policy period. “The ‘Auto Safe’ device is GPS-enabled and is linked to a mobile app that records all information, tracks the distance traveled, and generates reports about vehicle health or driving patterns of the policyholder,” it stated. And now welcome to 2021, like others there is no trace of UBI policies on the TATA AIG website also.

It is difficult to say whether it was a lack of response or lack of awareness for these kinds of products or there were other reasons as well for the present state of discontinuation by insurers who launched products like Pay how you drive on a pilot basis after approval in 2020 but in 2021 apparently have discontinued. From some informal inputs, we learnt that some of the companies consider that in the present state of affairs these products are not economically viable. These are loss-making products, there are some operational issues too. A cautious approach of wait and watch is preferable, especially in these times of pandemic where usage of transport, in general, has significantly reduced due to safety measures, like restrictions on gatherings, lockdowns, and so on.

Success or Failure of experimental offerings of UBI

Some Industry experts assure us that it does NOT appear to be a case of all is being lost, the insurers who offered telematics-based insurance seem to have the hope of UBI finding its place in the Indian Motor Insurance market as many of them have yet not removed the UBI policy features from their web sites. In fact, there are write-ups on the positive features of UBI and how these policies work.

According to Orbis Research (orbisresearch.com), the Automotive Usage-Based Insurance market was valued at US$ 19.64 billion in 2019 and is expected to reach US$ 124.02 billion by 2027; it is estimated to grow at a CAGR of 26.0% during 2020–2027. Interestingly this report includes India among the countries that are major contributors to industry share in the automotive usage-based insurance market. Apparently, it is the potential of India to contribute to usage-based automotive insurance.

Telematics Wire tried to take responses from some end-users; taxi drivers and others; it was found that people have very little awareness of Usage-Based Insurance programs in India. When it was explained to them that they have to pay an insurance premium based on the distance covered, the average speed of the vehicle, frequency of using the vehicle, and the overall driving skills and the information is used to calculate a fair and appropriate premium, the response from the users was positive.

The telematics-based car insurance policy experiment was only for the trial stage in India. Unofficial and largely unconfirmed market inputs suggest that Insurance providers who took the initiative to launch UBI products with a public caution of these UBI policies being experimental but internally considered it as a move to test the waters. Apparently, they did not get a good feel of the outcome of the trial run if not exactly burning their cash. But still, it was a very bold move considering the unchartered territory of the highly complex arena of telematics-based vehicle insurance. It can only be termed as a bold initiative of IRDAI and Insurers but it needs to explore further and further to reach a logical outcome from this experiment.

Global Scenario

Before we can think as to what is the future of the Insurance Industry in the Indian context in the light of emerging technologies that seem poised for disrupting the insurance space and change age old paradigms of insurance, let’s have a look at the global scenario of technology options and trends in UBI.

A closer look at the forecasts from market research companies indicates that the trend is shifting albeit much slower than desired from traditional ways of arriving at insurance premium for underwriting the insurance cover to telematics data-driven methodologies. But that is yet to happen in India in any sustained and substantial manner.

According to Allied Market Research, the global usage-based insurance market size was valued at $28.7 billion in 2019 and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. This type of insurance is mainly available in developed countries owing to which the majority of the key players of the market are looking to expand their business in developing countries of Asia-Pacific and LAMEA.

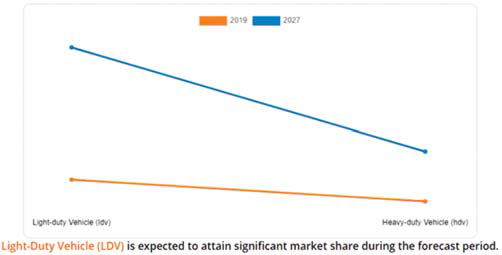

The global usage-based insurance market is segmented into type, technology, vehicle age, vehicle type, and region. Depending on the technology, it is bifurcated into OBD-II-based UBI programs, smartphone-based UBI programs, hybrid-based UBI programs, and black-box-based UBI programs. As per vehicle age, the market is bifurcated into new vehicles and used vehicles. In terms of vehicle type, the market is segmented into light-duty vehicles (LDV) and heavy-duty vehicles (HDV). Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

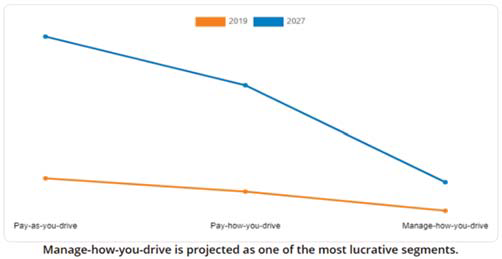

Source: Allied Market Research

Region-wise, the usage-based insurance market was dominated by North America in 2019 and is expected to retain its position during the forecast period. This is attributed to flexible driving, roadside assistance, and vehicle theft recovery. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to consumer awareness and major players in the market targeting developing countries of Asia-Pacific.

Source: Allied Market Research

Source: Allied Market Research

Source: Allied Market Research

The key players in the usage-based insurance markets in US, France Italy include (fig: 7):

Notwithstanding the positive forecast, many of the insurers, barring leading auto insurers such as progressive in the US, AXA in France and Switzerland, Generali and Unipol in Italy all over the world, are not very enthusiastic to push for UBI for a number of reasons. If the ratio of the number of vehicles globally under active UBI to the total number of vehicles all over is any indication, the growth will remain slow in the near future of 3-5 years unless various complex issues of concern are addressed.

Global Trends in sharing of driving data

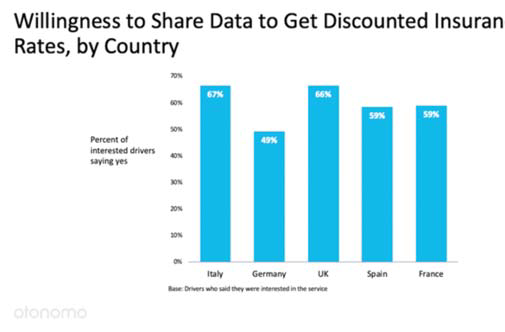

One of the most sensitive issues is whether the customers are willing to share their driving data or not. According to a recent survey of car owners in Italy, Germany, UK, France, and Spain Spain according to https://otonomo.io/blog/new-insurance-offerings-based-on-car-data/ The Most Experienced Consumers Express More Interest than UBI than Newbies. The survey conducted in these countries indicated a higher willingness factor in Italy.

The survey results clearly indicated that Italian consumers expressed significantly more willingness to share insurance-based driving data compared to others. The reason could be that Italy has telematics requirements encoded into law and the Italian insurance market has offered insurance contracts based on telematics for some time. Telematics penetration in Italy now stands at about 22%, according to the IoT Insurance Observatory. Ptolemus Consulting Group expects UBI policies to reach 170 million drivers globally by 2025. As connected cars dominate the roads, the data they generate can take even more of the friction out of UBI models for insurers.

Otonomo survey (fig: 8) also established that the right message for accepting to share driving data will draw a more positive response. It emerged in the survey responses that “20% cheaper car insurance” has so much more appeal than “discounted insurance based on driving data” underscores an important messaging strategy: the act of sharing data must be directly tied to a tangible benefit.

International policies on telematics-based insurance

According to a research report by Transport Research Laboratory some countries including Australia, Canada, USA, Germany, and Sweden, have some form of policy guidelines on telematics data. While USA has made it compulsory to install the Event Data Recorders (EDRs) a kind of black box that collects and records required data in the contingency of vehicle meeting any collisions. Apparently making the adoption of telematics for insurance purposes compulsory by law is a distant possibility as of now with Italy being an exception. In 2012 itself Italy introduced “Monti’s Law” making telematics compulsory in new cars and as an insurance option. With the penetration of UBI policies at a level of about 22%, Italy may be the most mature market for telematics-based insurance.

Indian Insurance Market

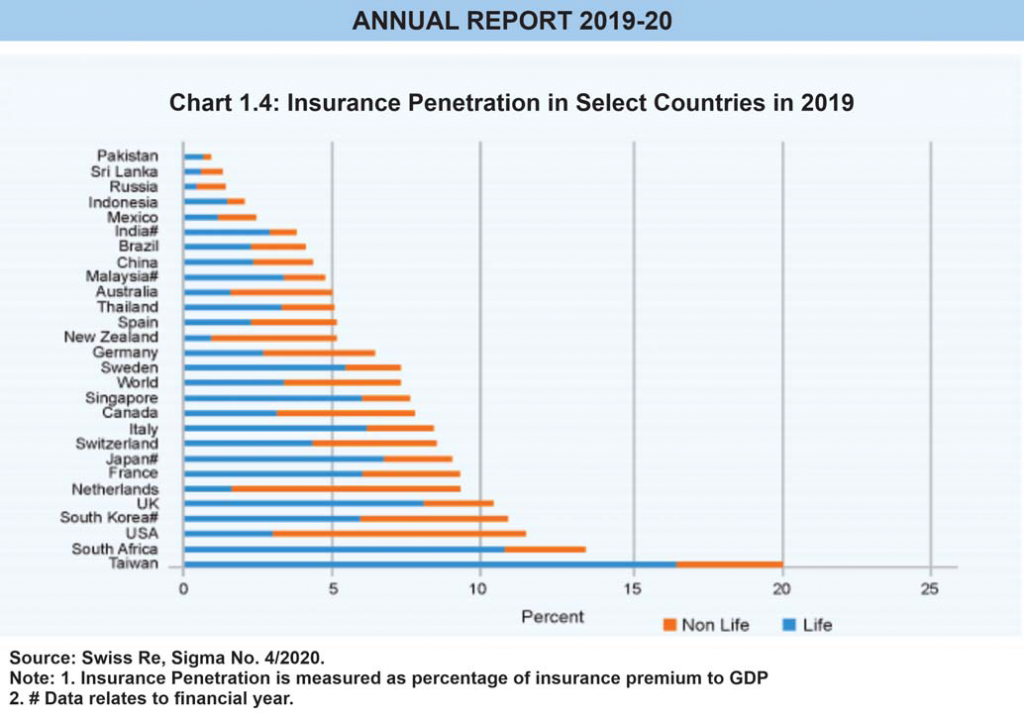

According to the IRDAI annual report of 2019-20 The penetration of the non-life insurance sector in the country has gone up from 0.56 percent in 2001 to 0.94 percent in 2019. Insurance Penetration is an indicator of the contribution of Insurance to the GDP and is measured as the percentage of insurance premiums to GDP. Indian non-life insurance sector witnessed a growth of 7.98 percent (5.70 percent inflation-adjusted real growth) during 2019. During the same period, the growth in global non-life premium was 3.35 percent (3.50 percent inflation-adjusted real growth). However, the share of Indian non-life insurance premiums in global non-life insurance premiums was at 0.79 percent and India ranked 15 in global non-life insurance markets. The share of Motor insurance in overall non-life insurance in India is just about 3 percent.

The figure (fig: 9) clearly shows that the Insurance industry in India is way down on the ladder of contributing industries from the global perspective.

Though lockdowns and other restrictions due to the Pandemic in 2019-2020, motor insurance in India saw a drop in its growth rate and overall share of general insurance (Non-Life), still among non-life segments motor insurance remained the biggest contributor with a share of 36.50 percent in 2019-20 (38.08 percent in 2018-19). The motor segment reported a growth rate of 6.86 percent in 2019-20 (8.91 percent in 2018-19).

The fact that though India, at present. has just 1% of vehicles in the world it maintains 3rd largest road networking the world and has a population equivalent to 17.7% of the total world population(https://www.worldometers.info/world-population/) gives apodictic assurance that there is a huge potential in India’s Motor insurance market.

UBI may not have had a bull run in the Indian insurance market so far but, it will definitely get a positive response from car owners. There will be some issues that would need careful and comprehensive addressing by regulators and the industry. Trust in truthfulness and comprehensiveness of data collected to draw conclusive rating assessment of driving behavior will demand comprehensive capture of not only driving data but contextual road and traffic conditions as well. Privacy and cyber security are highly sensitive and challenging issues that would need adequate security measures against hacks and compliances to avoid legal issues.

Another issue that needs to be tackled is consumer apprehensions about data sharing. In absence of any worthwhile awareness campaign, Indian drivers are doubtful about its usage and reluctant to accept sharing of data. But going by the ground feedback and survey reports in other countries it will need careful messaging to build trust. In the Indian market lower premiums, if offered in UBI policies as compared to traditional insurance, will have a desired pull. Did we not say India is a price-sensitive market? It can be expected that with time UBI will gain more acceptance among car drivers who are keen on road safety and understand the requirement of decent driving on Indian streets. Telematics is the first step on the road to the connected car. Any insurer who can understand, leverage, and monetize connected car data throughout the customer lifecycle, will be at a distinct advantage as connected car volumes grow in the Indian market too.

However, at present, the total cost of telematics devices including their maintenance is considered high enough which insurers do not like to absorb considering the thin margins and higher claim ratios. Government should take some steps to make people aware by incentivizing and subsidies UBI schemes.

What went wrong with trial run of UBI

There, virtually no awareness campaigns were run. Every now and then we see Sachin Tendulkar and other celebrities telling us that “Mutual Funds Sahi Hai”. No one is telling us that telematics-based insurance products are not only ‘Sahi’, but are required to have fair premiums and will go a long way in preventing road accidents and deaths.

It is axiomatic that this trial with UBI policies in motor insurance did not give the desired result since almost no one from the companies who had offered the UBI policies has renewed their offer publicly. Of course, not much is being shared by the insurers or IRDAI on this trial run of UBI. The lessons learnt are to be openly discussed and debated among stakeholders which must be identified with the aim of the group being inclusive and not exclusive which appeared to be the case with this sandbox experiment in the arena of Motor insurance. The reasons that UBI has virtually found a very damp response in the Indian market are far too many and the challenges were underestimated by the insurers and government alike in wooing the public in the Indian market. Some of the complexities in offering and managing the UBI policies are:

- UBI products are highly complex and insurers will require cross-functional teams to conceptualize, develop matured saleable policy products, and administer the policies in the entire life cycle of vehicles and their drivers.

- UBI policies take vehicle-related data into account as well as focus on how these are driven and other related attributes. This will involve huge data collection, storage, and big analytics.

- Inescapable involvement of device supplier or maintenance agencies for devices and vehicles, hardware and software support teams, data analytics specialists will make it more complex for insurers. It may be a factor for the reluctance of insurers to burn their cash in coming up with UBI policies.

- Managing the legal and regulatory hurdles will be entirely a different cup of tea with privacy concerns and data protection regulation becoming more and more stringent.

- Very difficult to determine the devices available that will meet the needs of the program

- Significant IT infrastructure development is required to collect driving data, to integrate UBI with the current system, and to give driving feedback

- No publicly available data to jump-start a program

- Risk of wasting time and money in collecting the wrong data

- Requires different analysis techniques as there will be a significant variance of driving data in different geographies, timings of travel road conditions, street furniture and so on. It may make it difficult to evolve the right matrix for arriving at fair and square premiums for different conditions and driving behavior.

New Beginnings

IRDAI constituted, in December 2019, a working group for improving Loss Prevention and Minimization(LPM), evaluate current practices followed by the insurance industry, and suggest approaches to stitch together the activities of various stakeholders involved in order to ensure better LPM

The working group, headed by Smt. T. L. Alamelu, Member (Non-Life), IRDAI with representatives from the insurers, brokers, General Insurance Council, National Insurance Academy, Insurance Information Bureau of India, and reinsurers, in its report, has recommended setting up a Section 8 Company promoted and outlined modalities of functioning of this proposed company.

Though the focal point of the new initiative by IRDAI is LPM it can be the harbinger of the much-needed technology infusion in the processes of Motor insurance. Apart from education, research and creating the right awareness through training, seminars, etc. the adoption of technology such as BlockChain, Telematics, Data Analytics, and Artificial Intelligence through an institutional set-up also figured in the recommendation of the working group. Once again it is a good step and can be a stepping stone for UBI to claim its rightful place in India’s motor insurance market.

En passant

Zoomcar has also taken the initiative to offer Zoomcar Mobility Services (ZMS) based motor-insurance products in the Indian market. In March 2021, in an interview with Moneycontrol, the Zoomcar CEO, Greg Moran said that the self-drive rental firm Zoomcar is in talks with general insurers to offer ZMS products in India. As of now, it is not clear that weather, the company has tied up with some insurers or and also it is not known that any requisite approval from insurance regulator IRDAI has been received by the company or not. Also, we did not find on the Company portal any offering of telematics insurance products. We look forward to the success of this initiative as it would definitely make a significant impetus for the growth of UBI in the Indian insurance market. It seems that it has not yet taken off.

Connected mobility and Insurance

Connected, Autonomous, Shared, and Electric (CASE) vehicles are bound to gain mileage in their journey toward mass acceptance. India is likely to witness mobility space being shared among the vehicles operating with singular or combinations of CASE technologies, if not in the twenties but surely in the thirties of this century. That could open up newer possibilities even in the motor insurance space in later years. With vehicles literally becoming AI-powered supercomputers on the wheel and ramping up of complexities with an increasing no of technologies converging into the vehicle may give rise to a situation where post-accident OEM-based repairs may be a more reliable and cost-effective option. Such a contingency may beacon OEMs to reworking on their business model. The ability of OEMs to access, process, and analyses the vehicle data for their cars data would make them uniquely positioned to offer a composite package of sale, maintenance, insurance deal for post-accident repairs.

Policy Push Required for UBI

There is a question coming up in some discussions that we have FAME for supporting adoption of EVs why can’t we have FAST (Faster Adoption and Subsidizing Telematics based Insurance).

Let’s look at the UBI from the lens of its role in reducing accidents. India has the third-largest road network in the world. According to a report on the number of operating vehicles in India FY 1951-FY 2019 published by Statista Research Department, Jul 29, 2021. The total number of vehicles in the fiscal year 2019 stood at 295.8 million. According to an NCRB report in the year Total (Motorized Transport) no of accidents stood at 137665 and accounted for 89% share of the total no of accidents. Besides the invaluable loss of human lives, a huge economic cost is paid by the nation. A recent study commissioned by the Ministry of Road Transport and Highways (MoRTH) estimates the socio-economic costs of road crashes at Rs 1,47,114 crore in India, which is equivalent to 0.77 percent of the country’s GDP (The Hindu Business Line).

With the increase of no of vehicles on the roads and alongside increased kilometers covered with rising logistics and transportation, personal travels by road have also led to an increasing no of road accidents. It is an established fact that bad driving has the largest share in making accidents on Indian roads.

In any policy formulation in any area of public need, attention has to be paid to the extent to which the perceived solution reduces the risk factors and potential beneficial spinoffs from the implementation of the solution. Telematics-based insurance is assumed to reduce accident rates by reducing risky driving behaviors. The feedback, incentives, and sometimes penalties associated with driving behavior, provided by the insurance companies induce better driving sense.

Left to market dynamics EVs would not have found their takers so early. It is the Govt push for EVs in form of regulations and subsidies which have yielded the right results in switching over to electric fuel. The same support is required for UBI to gain acceptance in the Indian market.

Conclusion

Vehicle Telematics has gained huge momentum in the recent past, and the reason being its enormous capability of working in the most complex environments and situations. Telematics-supported Usage-Based Insurance (UBI) programs are gaining huge traction and acceptance in the global motor insurance industry. These programs benefit both insurers and consumers by providing data for better risk assessment, as well as incentive-based, UBI programs. Insurance companies are leveraging telematics data to extract more information about the way a vehicle is being driven to offer more personalized services to customers in a cost-effective manner.

It will benefit society as a whole by laying stress on road safety and improving driver behavior to reduce the frequency and cost of accidents. It will help build the intelligent road infrastructure to reduce traffic congestion, pollution, and the number of road accidents. With better-priced and fairer policies, it will promote road safety, enabling safer, more efficient transport.

The future is as safe as you make it, and so the adoption of telematics in motor or vehicle insurance is the foundation stone for road safety and has to be backed by the mandate of law. It has to be supported in its infancy by government care, subsidy and enabling ecosystem. Modalities of implementation will have to be in phases and in context with other allied factors like demographic, geography, and awareness.

In a few words, the telematics data in motor insurance helps to make roads, safer, reduce the risk of miscalculating the risk and losing out on the premium, and fair-priced premiums for the insured where good driving behavior is a winner. Above all India would save almost 1% of GDP and millions of lives, erasing the stigma of Indian roads being the most dangerous place to be on.

Author:

Richa Tyagi

Editorial Team Member

Telematics Wire

Published in Telematics Wire

One Comment