Semiconductor Industry: Indian Overview

There have been many revolutions that we as a nation have allowed to go by without taking plausible benefits and seize the opportunities for driving the growth of related industries. The crying need of many industries in the general and the automotive industry for semiconductor shortage, in particular, is a grim reminder as to how we have missed the electronics revolution ushered by the exponential growth in usage of semiconductors in the 70s and 80s which made many smaller and budding economies rich and way ahead of us in this domain.

Semiconductors have become ubiquitous elements in the manufacturing of any electronic gadget. The term Semiconductor essentially refers to a specific category of materials having their unique electronic properties which are used in the manufacturing of various types of standalone discrete semiconductor devices used in an electronic circuit. However, their major usage lies in an integrated circuit (IC) usually referred to as chips. An IC chip may consist of two or more numbers of semiconductor devices which can be even in billions in modern electronic gadgets. Here the term semiconductors is interchangeably used to refer to any single discrete semiconductor device or integrated circuit (IC) chips.

Any and every product lying around us — whether it is an electronic gadget in the homes such as laptops, webcam, monitors, or vehicles like cars, buses, and trucks running on the road, there is always at least a tiny computing device fitted inside in the form of a chip that makes them work efficiently. As a matter of fact, the modern world relies on them.

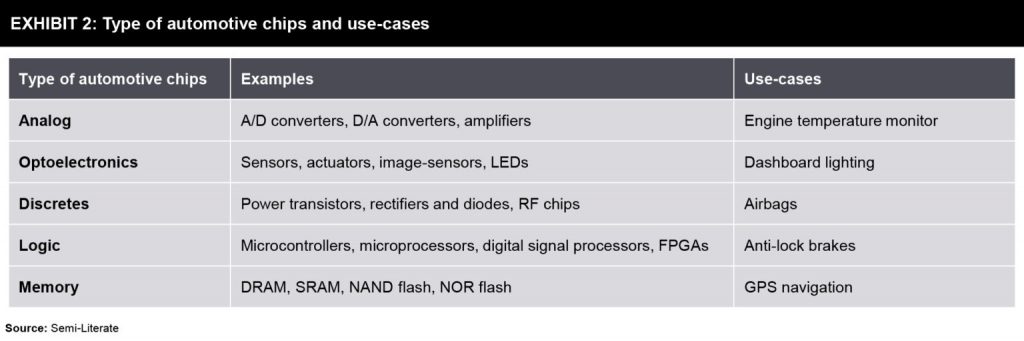

Chips or Semiconductors are the brain-center of any electronic technology. With the increasing demand and poor supply of automotive connectivity semiconductors, major economies globally are impacted. Automotive connectivity chips, that enable high capacity data networking, driver aids, and multiple electrical components, form a crucial component that silently powers the automotive and technology industry. There are different types of automotive chips for different use cases. In below fig.1 the types of automotive chips and their use cases are shown:

Pandemic and its impact on semiconductor industry

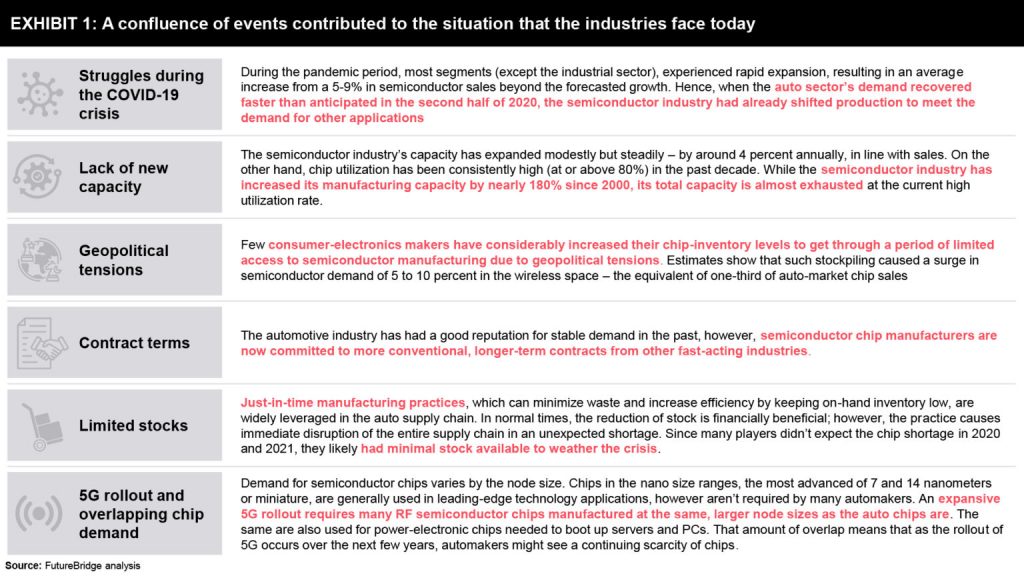

This semiconductors and chips shortage crisis gained attention due to the increase in demand for personal computers, tablets, and smartphones at the peak of the COVID-19 pandemic, which largely rerouted the supply away from the automotive sector. And of course, during the pandemic, many companies had to shut down their factories in South Korea and Taiwan. Taiwan is the biggest provider of semiconductors in the world whereas Taiwan Semiconductor Manufacturing Company (TSMC) alone has more than 50% share of the global supply market. Power outages, the worst drought in 57 years in Taiwan, fire incident in Renesas Electronics in Japan, Storm Uri in Texas also contributed though not significantly but added to the perception of a global semiconductor crisis.

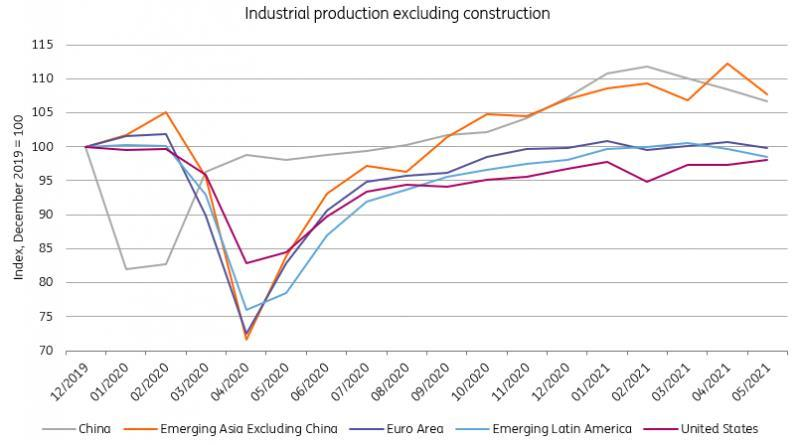

After the first wave of the pandemic in 2019, there was a steep fall in manufacturing activities the world over, as can be seen in the graph (fig.2) covering industrial production stats for China, Emerging Asia (primarily India and excluding China), Euro Area, Emerging Latin America and the United States.

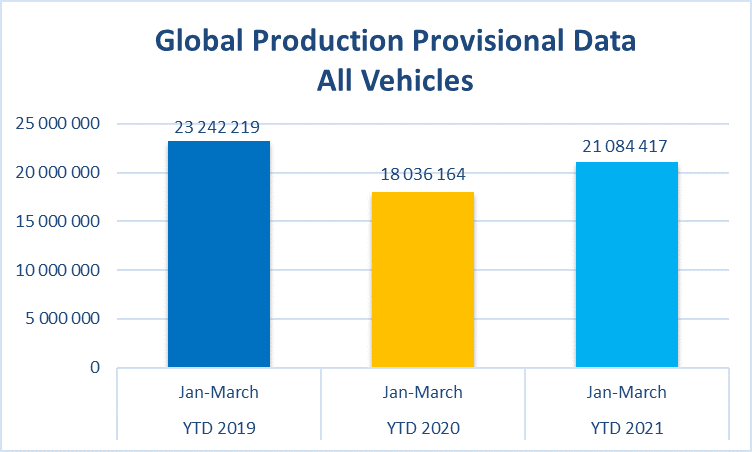

There was also a temporary fall in electronic gadgets demand but the demand side recovered more quickly with the massive intervention of the governments and the central banks to make money available in the markets to restore the products’ demands whereas manufacturing continued to lag behind the demand especially in the semiconductor segment. There was a relative easing of supply of more common family of semiconductors for electronic and electric products but automakers suffered from the lack of semiconductors which usually are more specific to the need of the automaker. ING’s Bert Colijn says ‘supply, not demand, is the problem for Europe’s businesses as they fight back against the coronavirus shock’. It is true almost universally for the automotive sector. Many production units either closed down or scaled-down their production which will take time to ramp up to meet the demand levels. With the vehicles becoming more and more software-driven, the dependency of the automotive sector on semiconductors continues to increase exponentially. Another push came globally from the rapid electrification of the automotive sector. OCAI data (fig.3) also indicates that the overall demand-side recovered in the auto sector more rapidly after experiencing a fall in 2020. There was a buzz that supply cannot fulfill the demand which led to extraneous factors adding to the scarcity of semiconductors.

World Top Ten Semiconductors Companies by Market Cap as on Sep 1st, 2021

| Rank | Company | World Rank (Sep-01-2021) | Headquarters |

| 1 | TSMC | 9 | Hsinchu Science Park, Taiwan |

| 2 | Nvidia | 11 | Santa Clara, California, USA |

| 3 | Samsung | 16 | Seoul, South Korea |

| 4 | ASML Holding | 26 | Netherlands |

| 5 | Intel | 49 | Santa Clara, California, USA |

| 6 | Broadcom | 56 | San Jose, California, USA |

| 7 | Texas Instruments | 73 | Dallas, Texas, USA |

| 8 | Qualcomm | 78 | San Diego, California, USA |

| 9 | Advanced Micro Devices (AMD) | 104 | USA |

| 10 | Applied Materials | 127 | USA |

Chip Shortage impact on global automotive manufacturing

Most of the industries have been negatively affected due to the semiconductor chip shortage, among them, the automotive industry is severely affected. It all started when automotive companies underestimated vehicle demand in early 2020 due to Covid-19. According to some reports, 2020 saw a gap of around 2-3 million units between vehicle production and their sales, indicating a supply shortfall of around millions. Chip shortage was the primary reason behind the supply-demand gap.

For some time now, global automakers have begun to ditch some features and electronic capabilities to manage the chip shortages they face today. For instance –

- Japanese carmaker Nissan is reportedly phasing out navigation systems out from thousands of vehicles

- On its Arkana SUV, Renault has stopped offering a larger digital screen behind the steering wheel

- Stellantis has modified its Ram 1500 pickup vehicle so that the digital rear-view mirror that usually comes as a standard is now only available as an upgrade option

- Rental car companies are also worried as they are not able to buy new vehicles they want. Hertz and Enterprise, a car rental company that profited from buying and leasing new vehicles, has reportedly resorted to buying used cars at auction instead.

Big automakers like Ford Motor and General Motors are expecting a huge cut in earnings this year due to chip shortage. Ford expects its earnings to drop by about $2.5 billion in 2021. GM expects the chip reduction to cut its earnings by $1.5 billion to $2 billion.

Chip Shortage impact on Indian Automotive Sector

A large number of semiconductors are used in any passenger vehicle, and any slowdown in the supply chain means a halt in the manufacturing operations. The global shortage of semiconductor chips has badly hit the Indian automotive sector. According to Dolat Capital, the automotive sector is facing the twin effect; semiconductor shortages and rising raw material prices besides increasing fuel costs. While retail demand is increasing month after month, the growing chip crisis is having an impact on production, especially in passenger vehicles.

Carmakers in India have been facing a major reduction in vehicle production because of the lack of availability of semiconductors. Automakers, including Maruti Suzuki India Ltd., Toyota India, and Mahindra & Mahindra Ltd have reduced production of vehicles substantially due to shortage of chipsets.

These carmakers have revised downward their dealer targets because of their inability to supply vehicles. Dolat Capital said, “Retail demand is 30-40% higher than wholesale resulting in inventory much below the normal level.”

Recently Maruti Suzuki gave a statement that in September its production will tumble up by 60% due to chip shortage in Gurugram and Manesar plants. It is anticipated that the total vehicle production volume over both locations could be nearly 40% of the standard production. Tata Motors also announced that it will be forced to cut down output in the coming months due to a shortage of availability of semiconductors.

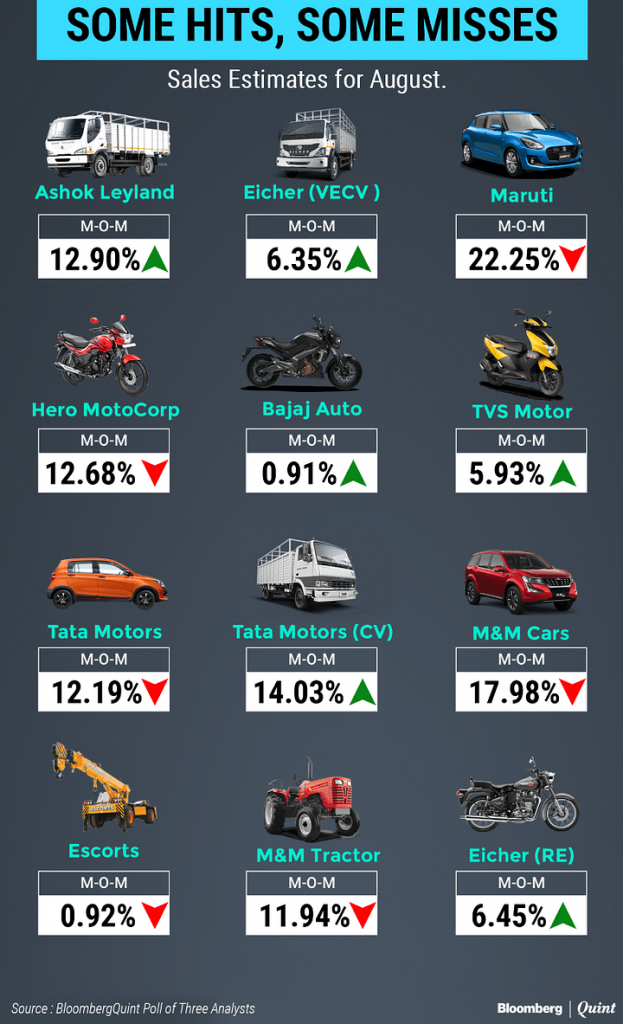

Automakers who were able to maintain their inventory beyond ‘just in time’ are less affected by the semiconductor crisis, as shown in Fig. 5 Ashok Leyland, Eicher (VECV), Bajaj Auto, TVS Motors, Tata Motors (CV), Eicher (RE), it could be anticipated as their sales are increasing. On the other hand, Maruti Suzuki, Hero Motor Corp, Tata Motors, M&M Cars, Escorts, M&M Tractor have had to stop their production due to low inventory.

Indian Manufacturing scenario

According to the India Electronics and Semiconductor Association (IESA), semiconductor consumption in India was worth US$21 billion in 2019, growing at the rate of 15.1 percent. Research and development in this industry, which includes electronic products and embedded systems, generated about US$ 2.5 billion in revenue. Yet, India lags in the establishment of semiconductor wafer fabrication (FAB) units – due to a weak ecosystem and shortage of resources as compared to more competitive bases like China and Vietnam.

The semiconductor companies can be divided into three types: chip manufacturers, fabless chip companies, and chip-equipment makers. Chip manufacturers have their own manufacturing plants. Fabless chip companies hire contract manufacturers to make the chips they design. Chip-equipment vendors supply the gear and materials used to produce semiconductor products. A look at the table below on the most significant Indian Companies in the semiconductor segment indicates the near absence of manufacturing capacity in India when it comes to the manufacturing of semiconductor chips.

Fabless Chip Makers in India

| S.No | Company | Products | Location |

| 1. | Saankhya Labs | Semiconductor Solutions | Bengaluru |

| 2. | ASM Technologies | Semiconductor Engineering | Bengaluru |

| 3. | Broadcom Inc. | Semiconductor and Infrastructure Software Solutions | Bangalore |

| 4. | Chiplogic Technologies | Semiconductor Design Services | Bangalore |

| 5. | CDIL | Semiconductor Manufacturer | New Delhi |

| 6. | MosChip Semiconductor Technologies | Fabless Semiconductor | Hyderabad |

| 7. | Einfochips | Semiconductor Design Services | Ahmadabad |

| 8. | Tata Elxsi | AI, Machine learning, NLP | Bengaluru |

| 9. | Semi-Conductor Laboratory | R&D in Semiconductor Technology | Mohali |

| 10. | NXP Semiconductors | Semiconductor Startup Incubation | Bangalore |

Semiconductor FAB units require not only huge CAPEX but also a matching OPEX as it requires uninterrupted water, electricity supply, highly skilled human resource, and the need for frequent technology replacement. This is why India’s contribution to the industry has remained confined to its technical expertise in R&D, design, etc. due to its software competencies in IT design and R&D engineers. The Indian semiconductor design market was projected to grow by a CAGR of 29.4 percent from US$14.5 billion in 2015 to US$52.6 billion in 2020. To bridge the gap, the Govt of India had granted LoIs for setting up FAB hits in Gujarat and UP.

The stark reality existing in the field of Semiconductor Manufacturing in India came out in a TOI news report in 2019 which mentioned the cancellation of LoI granted to a consortium led by HSMC Technologies India for setting up the country’s first electronic chip manufacturing plant. Going by the news, apparently, the government was then left with no proposal to set up any manufacturing plant for electronic chips, which are known as the heart of modern devices and considered strategically important in cyberspace. As per LoI, both the plants were to be set up with an investment of around Rs 63,000 crore. Post cancellation it was revealed that while the Government of Gujarat was willing to support any investor intending to set up a chip fabrication facility but did not intend to do it by itself, considering the investment required and the technology-intensive nature of the industry.

GoI thrust for Semiconductor Manufacturing in India

The Government of India is now trying to put India on the global map for semiconductor devices and chips and in order to overcome the capital-intensive hurdles. The government is actively seeking foreign capital to set up semiconductor manufacturing facilities in the country. India is setting up commercial semiconductor wafer fab units and the proposed locations are Greater Noida in Uttar Pradesh (about 40 km from New Delhi) and Prantij in Gujarat (about 50 km) from Gandhinagar.

Like most of the other countries in the world, India is also highly reliant on imports to meet the country’s semiconductor requirements.

Coronavirus pandemic has acted as an additional driver for rethinking the relationship between stakeholders. It has reinforced the need for greater resilience in the supply chain and highlighted the requirement to foresee and assess the manufacturing context in order to recalibrate inventory management in times of crisis. There are therefore several initiatives taken by the central government, focusing on the evolution and alignment of government policies that explore the possibilities to make the most out of the existing landscape in semiconductor manufacturing in India.

According to the India Electronics and Semiconductor Association (IESA), semiconductor consumption in India was worth US$21 billion in 2019, growing at the rate of 15.1%. Research and development in this industry, which includes electronic products and embedded systems, generated about US$2.5 billion in revenue. Yet, India lags in the establishment of semiconductor wafer fabrication (FAB) units – due to a weak ecosystem and shortage of resources as compared to more competitive bases like China and Vietnam.

Semiconductor FAB units require not only huge CAPEX but also a matching OPEX as it requires uninterrupted water, electricity supply, highly skilled human resource, and the need for frequent technology replacement. This is why, India’s contribution to the industry has remained confined to its technical expertise in R&D, design, etc. due to its software competencies in IT design and R&D engineers. The Indian semiconductor design market was projected to grow by a CAGR of 29.4% from US$14.5 billion in 2015 to US$52.6 billion in 2020. Indian Institute of Science, Bangalore, and the Indian Institute of Technology, Bombay have made strides in VLSI and chip design in their center of excellence in nano-electronics, at the same time leading chipmakers in the world are claiming to be making a breakthrough in manufacturing 1nm chips.

The Ministry of Electronics and Information Technology has now embarked on rebalancing our semiconductor manufacturing capacity vis-a-vis our needs for this vital ingredient of growth. Presently under the Electronics Hardware Schemes, there are the number of facilitating schemes which include Special Economic Zones (SEZ), Electronics Hardware Technology Park (EHTP)/ Export Oriented Unit (EOU), Export Promotion Capital Goods (EPCG) Scheme, Duty Exemption, and Remission Schemes and Deemed Exports. Though these schemes intended to incentivize & accelerate the development of electronics hardware manufacturing infrastructure in the country, they did not cover a significant need for this objective. The capital infusion is a must to build an indigenous industry for manufacturing electronics components and setting up R&D in this most dynamically changing industry. For the electronics industry, state-of-the-art R&D facilities and qualified human resources are a necessity for the survival of any enterprise in this domain.

The manufacturing of semiconductors is highly complex and capital intensive. This is an expensive truth which the government of the day has accepted and acknowledged as evident from its recent thrust to incentives and make capital available for setting up chips and semiconductor manufacturing plants and also for capacity enhancement of the existing ones. Notable initiatives undertaken by the Indian government for the development of the semiconductor industry included the enhancement of allocations of Modified Special Incentive Package Scheme (M-SIPS) and the Electronic Department Fund (EDF).

Notably, two schemes spearheaded by MeitY are worth looking at for their contribution to this industry, one is Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme which is a sequel of the Electronic Manufacturing Clusters (EMC) Scheme launched in October 2012 to provide support for the creation of world-class infrastructure for attracting investments in Electronics Systems Design and Manufacturing (ESDM) sector. The EMC 1.0 Scheme was closed for receipt of applications from October 2017. Another one is the Electronics Development Fund (EDF) policy which aimed at catering to the most crucial element that is funding to help Indian companies to take initiative in semiconductor manufacturing.

Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme (Ref: MeitY)

This is a new Avatar of Modified Electronics Manufacturing Clusters Scheme which was launched in 2012 and was closed in 2017. EMC2.0 was announced in April 2020 to create facilitating infrastructure for establishing electronics manufacturing in India. According to MeitY, the objective is to address the disabilities, by providing support for the creation of world-class infrastructure along with common facilities and amenities, including Ready Built Factory (RBF) sheds / Plug and Play facilities for attracting major global electronics manufacturers along with their supply chain to set up units in the country. This scheme will fortify the linkage between domestic and international markets by strengthening supply chain responsiveness, consolidation of suppliers, decreased time-to-market, lower logistics costs, etc.

The EMC 2.0 Scheme provides financial assistance for setting up of both EMC projects and Common Facility Centres (CFCs) across the country (information available on MeitY portal). The EMC 2.0 Scheme will help the Indian industry in a big way but it has a perspective of supporting of electronic products and sub-assemblies covered in the scheme.

SPECS

In April, 2020 Government came out with a scheme to address the critical requirement of semiconductor industry ie the availability of Capital with some incentives. SPECS, which stands for Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors, is to cater for requisite capital to domestic manufacturing of electronic components and semiconductors. Under SPECS financial incentive is capped at 25% of Capital outlay for those category of electronics items which have been brought in to the ambit of SPECS for financial incentive to the entities registered in India (Information available on MeitY portal).

Electronics Development Fund (EDF) policy

Electronics Development Fund (EDF) is another step by the government to make funds available through professionally managed funds which are drawing their seed capital from the government through EDF. These would provide risk capital to companies developing new technologies in the area of Electronics, Nano-electronics and Information Technology (IT) (Information available on MeitY portal).

Can the gap in technology & manufacturing capacity in the semiconductor domain between India and global players be bridged in next decade?

According to a post in India Briefing, over 20 semiconductor manufacturing and designing companies in high-end, display, and specialty fabrication have reportedly submitted Expressions of Interest (EOIs) to set up manufacturing plants in India.

The government is open to introducing new incentives for chipmakers, beyond those detailed in the PLI scheme for large-scale electronics manufacturing. It will likely be based on the investment coming in and the company’s area of work, type of fab, and requirement. Earlier this year, the Indian government also sought proposals from interested applicants to either set up (and/or expand) semiconductor wafer/device fabrication plants (FABs) in India or their acquisition outside India. To ensure targeted interest from foreign players, the government also invited leading international players. The proposals were to be submitted to MeitY by April 30, 2021. The notification about the Expression of Interest was available in Korean, Japanese, Hebrew, and Chinese – an indication of the expected investment interest from foreign players. According to a business standard news report in July 2021, the Ministry of Electronics and IT approved 14 eligible applicants under the Production Linked Incentive Scheme (PLI) for IT hardware. The target segments under the PLI Scheme for IT Hardware include laptops, tablets, all-in-one personal computers, and servers.

PLI II came out in March 2021 and has been appreciated by media, industry icons but it is just the beginning of an uphill climb. The huge investment required, cutting edge technology and proven manufacturing processes in semiconductor manufacturing are one part, another important issue is the availability of qualified and trained human resources willing to opt for a career in semiconductor manufacturing. The shortage of manpower is indicative from the Naukri.com job portal ad for filling up 60466 semiconductor jobs in Manufacturing. A substantial number of our electronics engineers coming out of engineering institutions every year tend to be swept off in the coding stream for want of job opportunities in electronics manufacturing. Trained human resources at a reasonable cost are going to be one more essential in setting up semiconductor manufacturing plants in India. Though we have the advantage of having a good number of engineering institutions with electronic streams, we need to create a brighter career path for young engineering pass outs to prefer semiconductor manufacturing over the jobs in the IT sector.

Author

Richa Tyagi

Editorial Team Member

Telematics Wire

Published in Telematics Wire