Aptiv completes the acquisition of Wind River from TPG

Aptiv PLC has completed the acquisition of Wind River®. Wind River software enables the secure development, deployment, operations, and servicing of mission-critical intelligent systems. The company’s technology is in over two billion edge devices across more than 1,700 customers in high-value industries, including aerospace and defense, telecommunications, industrial, medical and automotive.

“Across multiple industries, mission-critical applications are undergoing a digital transformation as devices become smarter and generate more data, creating a need for more intelligence at the edge and edge-to-cloud software solutions to unlock new business models,” said Kevin Clark, Aptiv’s chairman and chief executive officer. “The automotive industry in particular continues to be transformed by the accelerated shift to software-defined vehicles. Empowering our customers to capitalize on this transition requires not only a next-generation hardware architecture, but also a cloud-native software architecture and an edge-to-cloud DevOps platform that speeds software development, streamlines deployment to vehicles and enables lifecycle management. With Aptiv and Wind River’s complementary portfolios and decades of combined experience in delivering innovation in safety-critical systems, we will drive significant value for our customers.”

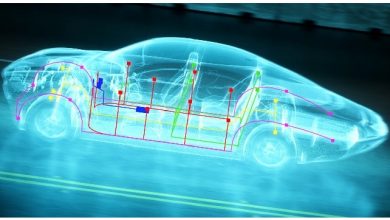

Wind River’s proven technologies have been used across multiple industries to address the challenges the automotive industry is facing. By integrating the Wind River Studio cloud-native software platform into Aptiv’s Smart Vehicle Architecture™, Aptiv will enable customers to unlock the full potential of the software-defined vehicle throughout its complete lifecycle. The initial release of the integrated end-to-end solution will be showcased in January at CES 2023.

The transaction is valued at $3.5 billion, instead of the initial purchase price of $4.3 billion agreed to in January 2022. Aptiv and the seller agreed to the amended purchase price, in part, as a result of certain changes in Wind River’s current operating structure required to bring the regulatory approval process to a satisfactory conclusion. These changes will not impact the strategic direction of Wind River nor our expectations for its value creation, but will require certain one-time costs and recurring operating expenses. The transaction is expected to be accretive to adjusted earnings per share in 2023. The company will provide further details regarding the transaction on the fourth quarter earnings call on February 2, 2023.