Capgemini: "Connected" vehicle as a node on the network

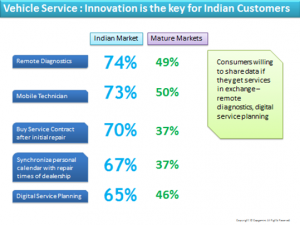

Indian Customers are willing to share the vehicle data provided they are getting services in exchange.

Nick Gill, Chairman of Global Automotive Sector | Capgemini

Today Indian consumers expect connectivity services in their vehicles more than ever before. OEMs see them as an opportunity to create value; others are interested in the data that they generate. OEMs’ existing business models cannot support full realization of the Connected Vehicle vision, partly because of the much shorter development life cycle that is required for services, but also because the services raise legal issues, and require collaboration across functional boundaries, together with new architecture and processes. A new approach is therefore required: one that supports this new way of creating value through services, that enables collaboration across functions to provide the requisite data and knowledge, and that enables agility. Introducing this new architecture is a significant task but brings major benefits.

The opportunity of the Connected Vehicle

In the digital landscape, in-line with their Global counterparts, Indian consumers’ expectations of cars are changing. They want their car to be “just another node on the network” – an extension of their home, office or club. It should streamline their lives rather than giving them extra work or interrupting what they’re doing. For example:

- A driver should be able to turn on the AC before arriving at the vehicle.

- The office should be notified when the individual is about to arrive so that parking space gets allocated.

- Home AC should automatically get turned on ahead of the resident’s arrival.

- An individual’s preferred radio channel and routes should be selected when they get into the car.

- Safety systems equivalent to those in the home, such as emergency buttons, should also be available in the car.

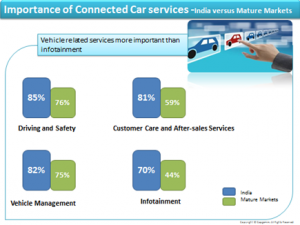

Major areas where services will be provided include driving and safety, vehicle management, aftersales, infotainment and fleet management. At the same time, the importance of multi-channel connections and social media usage is growing. There is also a strong demand for mobility services.

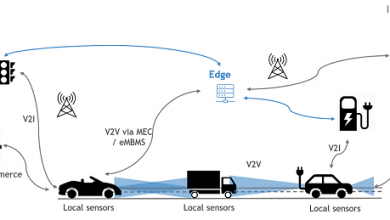

Connected vehicles meet these consumer expectations by facilitating communication between consumers, cars and buildings, and sometimes between different vehicles, via the “Internet of Things”. This idea is attracting attention from consumers, OEMs and third parties:

- Consumers. Capgemini’s annual Cars Online consumer survey confirms the growing interest in these ideas. “As consumers become more familiar with the idea of a connected car, their interest in owning one increases.”[1] In fact, this feeling is rapidly evolving from an interest to a strong demand that will force OEMs to change their offering.

- OEMs. Connected vehicles are on our roads already, though not yet in great numbers. Premium brands like BMW are leading the way, and almost every new car has at least some connected services. OEMs are also starting to address the need to continue providing services during the extended model lifecycle – for instance, for used cars so that the focus is shifting from purchase to ownership.

- Dealers. Connected Vehicle data and services can help dealers to provide maintenance. However, some dealers are wary because they are afraid of losing customer ownership to OEMs.

- 3rd parties. Different players are approaching the scene and trying to get their share – specifically, their share of the customer data. Insurance companies, dealers, third-party service suppliers – virtually anyone dealing with consumers has a potential interest in getting data that’s available through connected vehicles. This information could be anything from where the individual stops to what speed they are doing. Companies such as Google are investing and innovating in this area; they have a different mindset around business case development, and bring values from the digital economy to the automotive world.

The Indian Context

Our research has shown that for Indian Consumers, Vehicle related services like Driving and Safety, Vehicle Management and after-sales are more important than Infotainment. Vehicle is not being seen as Primary source of Infotainment.

Also, Indian Customers are willing to share the data provided they are getting services in Exchange. The most preferred partners to whom Customers are willing to share Personal and Vehicle data are* –

- Vehicle Manufactures (72%)

- Dealer (57%)

- Insurance company (39%)

- Roadside Assistance (30%)

- Other Cars/Drivers (32%)

- Technology companies like Google, Microsoft, Apple, etc. (19%)

- Telecom provider (22%)

Managing the transformation – Creating Value through Connected Vehicle Service

The transformation to a coherent, fully thought-through service offering has to start now.

The OEM need to create the business model for creating value through services

Experience shows that companies can tackle these challenges more effectively once they adjust their overall business model. The new business model needs to clarify how the company intends to create value for consumers through services and define the path that they will take to position themselves to do so.

Figure : High-level model for integrating vehicles and services into the network

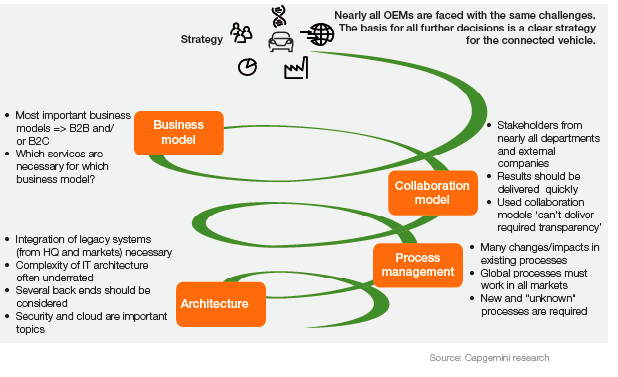

OEMs need to shift their focus away from the moment of purchase to the time of use: the whole period when the vehicle is owned by the buyer. Making this shift successfully requires a clear and well-defined strategy and methodology, as illustrated on the above.

The overall strategy must include elements of the business models for used cars and those for new cars, as well as various B2B models. With B2B, other players are interested in vehicle or consumer data: for example dealers, rental companies, insurance companies, car clubs, and fleet operators, in addition to B2C service providers. The interested parties and business models, as well as the legal and political constraints and requirements, can be different for each market.

It is therefore important to carry out a separate evaluation for each intended market. This leads to a clear roadmap for the introduction of connectivity services.

Figure : The journey to a new business model requires a clear strategy and methodology

Reshaping the company to be agile enough to deliver connected vehicle services is certainly not a trivial undertaking, and the challenges continue into the future. Leveraging connectivity in the vehicle fundamentally changes the nature of the product and the interaction with the customer. Keeping the connected vehicle up to date requires a continuous joint effort on the part of business and IT going beyond the conventional vehicle development cycle to the end of the model lifecycle: potentially up to 50 years into the future.

Capgemini has extensive experience of applying these approaches with leading automotive companies, and understands the need to ensure that they are sustainable in the long term

About the author

Nick Gill is Capgemini’s Global Automotive Council Chairman. Capgemini’s Automotive practice serves 14 of the world’s 15 largest OEMs and 12 of the 15 largest automotive suppliers. Nick is coordinating all Capgemini activities with its automotive clients globally providing executive support for major projects, large opportunities, emerging markets etc

Co-author and Regional Contact Person

Vaibhav Mahajan, Sr. Manager, Capgemini India

Vaibhav is senior Leadership member in CHROME, Automotive and Manufacturing CoE of Capgemini. He assist Clients with Business Transformation, Implementation of Best Practices, Cutting Edge Technology and Process solutions with Focus on Automotive Industry.

Sources: [1] Capgemini, Cars Online 2014 – Generation Connected, 2014, page 7