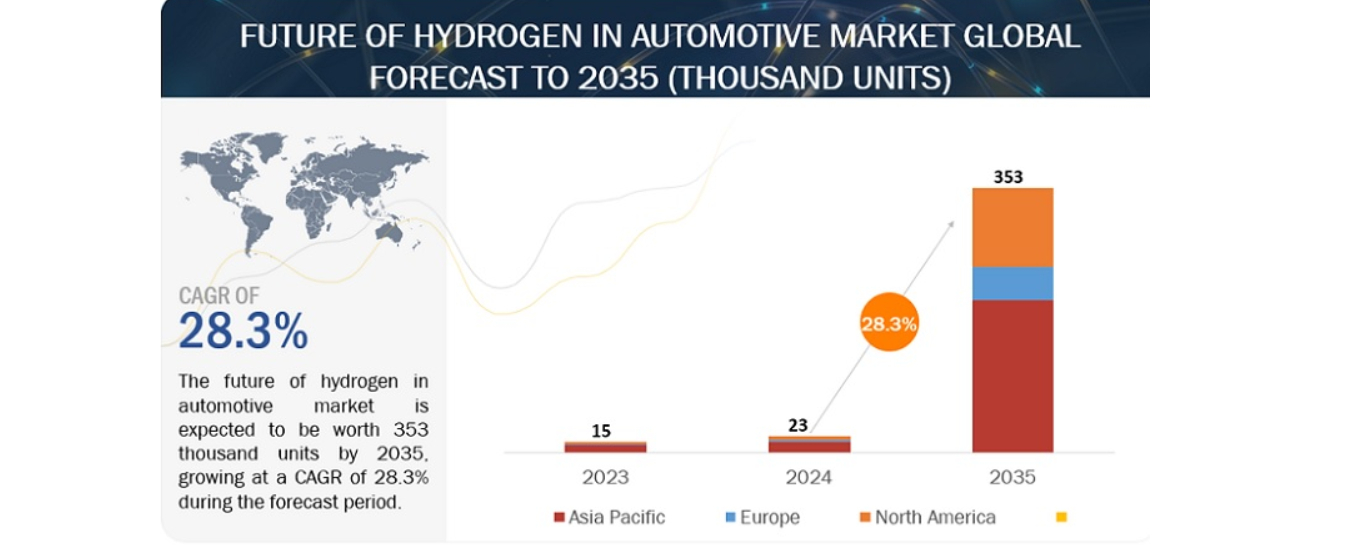

Hydrogen automotive market to surge: 23K to 353K units by 2035

CHICAGO, April 4, 2024 /PRNewswire/ — Future Of Hydrogen in Automotive Market size is projected to grow from an estimated 23 thousand units in 2024 to 353 thousand units by 2035, at a CAGR of 28.3%, according to a new report by MarketsandMarkets™. Factors such as higher driving range than battery electric vehicles, zero-emission nature of the hydrogen-powered vehicle, and government plans for zero-emission transport across the globe, have resulted in automakers announcing plans to embrace hydrogen-powered fuel cell vehicles and the expansion of the future of hydrogen in automotive market. Similarly, technological developments by leading OEMs such as BMW (Germany), Toyota Motor Corporation (Japan), and Hyundai Motor Company (South Korea) are further propelling the market growth.

Future of Hydrogen in Automotive Market Scope:

| Report Coverage | Details |

| Market Size | 353 thousand units by 2035 |

| Growth Rate | CAGR of 28.3% |

| Largest Market | Asia Pacific |

| Market Dynamics | Drivers, Restraints, Opportunities & Challenges |

| Forecast Period | 2024-2035 |

| Forecast Units | Value (Units) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Vehicle Type (Passenger Car, Light Commercial Vehicle, Bus, and Truck), Propulsion Type (FCEV, FCHEV, and H2-ICEV), H2 Refuelling Points (Asia Pacific, Europe, and North America) and Region |

| Geographies Covered | Asia-Pacific, Europe, and North America |

| Report Highlights | Updated financial information / product portfolio of players |

| Key Market Opportunities | Government initiatives promoting hydrogen infrastructure |

| Key Market Drivers | Reduced oil dependency |

“H2-truck segment is expected to hold the significant market share during the forecast period.”

Hydrogen-powered trucks are expected to play a pivotal role in the automotive industry. Until 2035, a 36.6% CAGR, driven by innovation efforts from major OEMs like Volvo (Sweden) and Daimler (Germany), is evident. Hydrogen-powered trucks hold a significant portion of the Asia Pacific market, particularly leading in China. Similarly, there is a rapid surge in demand projected for hydrogen-powered trucks in the US. This is supported by the nation’s ambitious USD 7 billion hydrogen hub initiative aimed at establishing hydrogen refueling stations or hubs nationwide. Leading models such as the Hydzon Hymax and Hyundai XCIENT are driving the H2 truck market forward. Additionally, OEMs including Scania, Volvo, and Daimler are strategizing to introduce their hydrogen-powered trucks soon.

“H2-ICE segment expected to be the next big shift during forecast period.”

The utilization of hydrogen internal combustion engine (H2-ICE) powertrains, particularly in heavy-duty trucks, expected to grow significantly during the forecast period. OEMs are outlining strategies for the introduction of H2-ICE-powered heavy-duty commercial vehicles and passenger cars. By 2035, experts anticipate that H2-ICE technology will experience mainstream adoption. H2-ICE vehicles exhibit enhanced efficiency and reduced fuel consumption.

The transition to H2-ICE architecture appears more feasible compared to fuel cell electric vehicle (FCEV) architecture. This is primarily due to its independence from costly materials like platinum, thereby contributing to cost reduction. These advantageous attributes have spurred prominent automakers and engine manufacturers to pivot towards incorporating H2-ICE components into their vehicles. In January 2024, Bosch GmBH from Germany revealed its intention to commercially release a hydrogen internal combustion engine for HCVs. In January 2024, Volvo unveiled plans to develop H2-ICE engines, aligning with its hydrogen-focused strategies, as an alternative to FCEVs.

“North America to be the fastest growing market for H-2 Pickups and HD Trucks during the forecast period.”

North America expects to witness significant growth in the market for fuel-cell electric vehicles, with the United States maintaining a dominant share of 94% within the region. Toyota emerged as the frontrunner in the North American market, commanding an 89% market share as of 2023. Projections suggest its continued leadership, bolstered by the implementation of hydrogen subsidy initiatives. The setup of fixed H2 refueling stations stalled in California in 2023.

However, the US is strategizing the establishment of portable hydrogen refueling stations beyond California. Models such as Toyota MIRAI and Hyundai NEXO dominate sales in the region. An increasing focus on pickup trucks is anticipated as major OEMs plan to diversify into hydrogen fuel. North America, emerging as a pivotal region in the fuel cell electric vehicle market, sees leading OEMs planning new launches. Further, Hyundai XCIENT, Van Hool A series, Nikola Motors Tre, and NFI Xcelsior are some of leading FC commercial vehicles presently available in the market. Moreover, Toyota Hyluz and Daimler H2 truck are expected to be launched by 2026.

Key Market Players:

The major players in Future of Hydrogen in Automotive Companies include Toyota Motor Corporation (Japan), Hyundai Motor Company (South Korea), SAIC Motors (China), FAW (China), and Yutong (China) among others.