The road to 5G: The inevitable growth of infrastructure cost

With a gross revenue of ₹1,50,173 crores, India recently witnessed the official launch of 5G services by the Honorable Prime Minister at the India Mobile Congress 2022. The fifth-generation mobile connectivity is designed to deliver higher multi-Gbps peak data speeds, ultra-low latency, enhanced reliability, massive data capacity, vast network bandwidth, higher performance, and a more uniform user experience across the country.

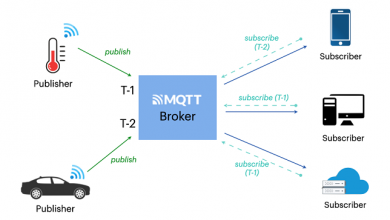

5G is a unified interface that utilises advanced technologies like IoT, M2M, AI, Edge Computing, Robotics, etc., to support all spectrum types (licensed, unlicensed, shared), bands (low, mid, high), deployment models (macro-cells, hotspots), and multi-device connectivity. The 100x amplification of network efficiency and traffic capacity is expected to generate a cumulative economic impact of $ 1 trillion by 2035.

5G will be a transformational force for Indian society. It will facilitate innovations and development across various sectors. For instance, the concept of an ‘online university’ will leverage the high-speed 5G network to bring education to millions of disconnected learners, particularly in rural areas. The technology will boost the automobile industry with improved vehicle-to-everything (V2X) communication, real-time information on traffic and congestion, and enhanced visibility to avoid safety incidents.

According to a Hans India report, 5G will revolutionise India’s agriculture sector with precision farming, optimum cost realizations, utilisation of crop and livestock resources, intelligent management, and an affordable price for the end users. However, the meaningful rollout of 5G services in the country will require at least Rs. 1.5–2.5 lakh crores of Capex in the next two to three years.

Types of Investments in India’s 5G spectrum

India’s 5G services hold promising investment opportunities to reach an estimated market size of INR 19,053.19 billion by 2025. Based on an EY survey report, more than 70% of Indian enterprises are expected to make the highest investment in 5G compared to other emerging technologies in the next three years. By 2025, the Indian telecom giants will invest around $19.5 billion in developing the country’s advanced infrastructure, while the government will ensure last-mile accessibility to 4G and 5G connectivity in remote villages with a $30 billion expenditure.

5G investment in the country can broadly be classified into active and passive components. The active component comprises the Original Equipment Manufacturers (OEMs) and application developers who aim to invest in upgrading the current networks at the brownfield sites and establishing new infrastructure at the greenfield sites to deliver robust connectivity.

Conversely, passive investments involve expenses on conversion equipment, energy management solutions, energy backup systems, remote monitoring solutions, renewable resource utilisation, and smart cooling technologies. Leading power and energy management companies are providing advanced electronic components, telecom power solutions, industrial automation, and high ratting UPS and data center infrastructure to support the booming 5G framework of the country.

Passive components primarily aim to fund the 5G infrastructure either organically or through indirect investments. In the auction for rolling out the 5G ecosystem, the government fetched the highest-ever amount of Rs. 1.5 trillion from operators. Now, operators will further rely on telecom tower companies, and system integrators (SIs) for putting up 5G infrastructure. As a result, several layers of the industry will witness potential expansion with organic investments in infrastructure, FTTH, and inorganic investments through corporate initiatives.

Organic Investments

At IMC 2022, the Department of Telecommunications (DoT) urged early-stage startups and local stakeholders to invest in India’s 5G technology stack. Accordingly, companies will invest in the organic growth of infrastructure and network proliferation to roll out the ecosystem.

Investments in Data Centre Infrastructure

Based on an ICRA report, the Indian data centre market is expected to witness a five-fold growth with an investment of Rs. 1.05-1.20 lakh crores in the next five years. Especially, Edge Data Centres are experiencing a boom in tier-2 and tier-3 towns to provide a better user experience and help adopt digital services. As the name suggests, edge data centres are responsible for the real-time processing of end-user data at the edge of the network and delivering cloud computing resources and cached content.

The expansion of data centres demands an adequate supply of power solutions and backup systems. Most data centres obtain their power supply from municipal electric grids. They then convert the power from AC to DC through transformers and distribute it to multiple endpoints such as Uninterrupted Power Supply (UPS) systems. The data centre industry consumes overall electricity of over 90 billion kilowatt-hours annually to keep the IT infrastructure rolling. Such a massive power supply requires alternative energy sources like solar photovoltaic panels and efficient backup systems to combat outages.

Leading power solution providers cater power infrastructure to data centres and colo companies with integrated energy-saving power components like UPS and distribution units. Their robust power devices, racks and accessories, precision cooling technologies, and environmental management systems offer a modular design, scalable architecture, and optimum space utilisation. Moreover, some power solution providers support green data centres and save more than 25% of energy at reduced operating costs.

According to an Arizton report, the Indian data centre market is projected to reach $10.09 billion by 2027, growing at a CAGR of 15.07%. The 5G ecosystem requires a critical network infrastructure for ultra-scalability and a low-cost, high-quality Internet that deploys IoT devices to gather real-time insights. Such configuration attracts investments from hyper-scalers like Amazon, Google, and Microsoft to draw on their processing power and deliver state-of-the-art customer services.

A hyper-scale data centre typically exceeds 5,000 servers and 10,000 square feet, delivering 40 GigaBytes per second or faster network connections. It offers a perfect power usage efficiency (PUE) of 1.1 from a performance point of view. This way, hyper-scale data centres emphasise stripped-down hardware, maximum disaggregation of components, modularity, automation, and other scalable principles.

Investments in Network Densification

5G involves more phases and varied capabilities than any preceding wide-area wireless technologies. This necessitates a balanced brand-new standalone network core and a non-standalone (NSA) network overlay on an existing 4G LTE network. The interoperability of both networks will be critical for the next four years to provide excellent service and a positive user experience.

The existing 4G LTE network core facilitates the quick rollout of NSA 5G to offer increased network speed. It supports enhanced Mobile Broadband (eMBB) solutions and allows the deployment of pilot projects to initiate innovative use cases. However, standalone 5G networks deliver massive machine-to-machine communication, real-time device-to-device networking solutions, ultra-reliable services, and low-latency functionality for autonomous devices and next-gen IoT.

Thus, telecom providers will eventually move to standalone 5G to include complementary components like edge infrastructure, dynamic spectrum sharing, and network slicing functionality. They will add more cell sites in greenfield regions and hybridise the existing brownfield sites to increase the available capacity.

Network densification will increase traffic per square meter and reduce base-station-to-terminal distances, corresponding to an improvement in achievable data rates. Small cell deployment will follow a simplified Right of Way (RoW) application procedure. The government will permit service providers to use street infrastructure to deploy the network at a nominal cost of INR 150 per year in rural areas and INR 300 in urban areas.

Installation of telecom infrastructure, including towers, poles, and optical fibers, will be accelerated. A GlobalData report highlights that the Indian government projects to install optical fibre connectivity across 6,00,000 villages under its “Digital India Mission’ program by 2023. This will facilitate the growth of the total fibre optic access lines to 10.19 million, covering more than 5 million kilometres by 2025.

Investments in Fibre to the Home (FTTH)

Telcos are estimated to spend around $1.5-2.5 billion on optical fibre cables (OFCs) in the next three to four years to power 5G services and meet the demand for fibre-to-the-home (FTTH) fixed broadband.

With increased data consumption for video viewing on YouTube and OTT platforms, online shopping, and remote working, residential FTTH fixed broadband connections have grown to 57.3% as of 2021. It is estimated that approximately 10M FTTH distribution fibres are required to provide high bandwidth infrastructure across metro cities, enterprises, hospitals, transportation, and educational institutions, taking into account 27 crore households and 8 million MSMEs. Thus, corporate Internet service providers like Bharti Airtel, TataSky, Reliance Jio, and government telecom organisations like BSNL are committed to boosting the Indian fibre broadband sector to 80 million by the end of 2030.

Government Initiatives

Under the National Optical Fibre Network (NOFN), Bharat Broadband Network Limited has expanded OFC connectivity in all state capitals, districts, HQs, and block levels. Moreover, the organisation plans to connect 2,50,000 Gram Panchayats by utilising existing fibres from BSNL, Railtel, and Power Grid and adding fibres wherever necessary. The project estimates a cost of about Rs. 20,000 crores to provide non-discriminatory access to telecom service providers (TSPs), ISPs, and content providers across rural areas.

Furthermore, the government is funding projects of BSNL and ITI to develop indigenous technology for the 4G, 5G, and E-band spectrum. Accordingly, BSNL will deploy a 4G network with a Rs. 1,64,000 crore investment across 100,000 sites. After the completion of the project, the existing core networks will be upgraded to offer 5G services through non-standalone gateways.

Meanwhile, the ‘Atmanirbhar Bharat’ mission invested around Rs. 2426.39 crores to enable better Internet and data services in the left-wing extremism (LWE) areas. BSNL has been chosen to operate the prestigious project and deploy 4G equipment for the rural population and security personnel. Aligning with the country’s defence telecom infrastructure, the Indian Army is looking to set up a 5G network along the borders to improve mission-critical communications and achieve a high-speed data network for operational requirements.

Inorganic Investments

5G spectrum auctions in India allocated 51,236 MHz to four major telecom tycoons. With an Rs. 88,078 crore bid, Reliance Jio won more than half of the airwaves, followed by Bharti Airtel (Rs. 43,084 crores), Vodafone Idea Ltd. (Rs. 18,799 crores), and Adani Group (Rs. 212 crores).However, mid-or low-band spectrum coverage of 5G networks pan-India requires about Rs. 1.3-2.3 lakh crores of Capex on the key components.

Over the next four years, Reliance Industries Ltd. (RIL) will invest Rs. 75,000 crores in setting up four New Energy Giga Factories across 5,000 acres. These units will comprise an integrated solar photovoltaic modular factory, an energy storage battery factory, an electrolyser factory for producing green hydrogen, and a fuel cell factory for converting hydrogen into motive power.

Supporting the ‘Make in India’ initiative, the telecom giant announced the development of an indigenous 5G technology to connect telecom, e-commerce, retail, and enterprise solutions in India and abroad. The company has collaborated with Google and raised $4.5 billion in investment to deploy affordable 4G and 5G smartphones in the country.

Furthermore, Vodafone Idea Ltd. is expected to overcome its financial pressure and begin its 5G rollout journey soon. On the other hand, Adani Enterprises acquired 400MHz of the spectrum to integrate its digital infrastructure portfolio, including data centres, terrestrial fibre and submarine cables, industrial cloud, AI Innovation Labs, cybersecurity, and SuperApps.

Final Thoughts

India’s 5G ecosystem is projected to account for 40% of mobile subscriptions by 2027 and generate incremental revenue of US$17 billion from enterprises by 2030. It will facilitate the launch of new services like home broadband (5G FWA), enhanced video, multiplayer mobile gaming, and AR/VR services. Greenfield networking will allow industry participants to invest in new technology stacks such as passive optical networks, fibre optic switching, and 5G Radio (5G NR) technology. Existing and new greenfield sites will undergo hybridisation to provide stability and cut costs. In a nutshell, the life-changing 5G technology will potentially attract massive investments from telco giants to support innovations and enhance business efficiency.

Author:

Rajesh Kaushal

LOB Head – India & SAARC Communication & Information Solutions Business Unit | ICTBG

Delta Electronics India

He is responsible for leading the profitable growth of the Communication & Information Solutions (CIS) Business Unit for Delta Electronics India that consists of Telecom Power Solutions, UPS & Data Center Solutions, Networking Systems and Power Quality Solutions. He is a Solution Sales Strategist, with over 26 years of work experience. He is self-motivated professional with proven managerial experience and an outstanding track record in driving business expansion.

Published in Telematics Wire