Infrastructure to enable connected vehicles

The emergence of vehicle-to-everything (V2X) communication has attracted participation from software, hardware, and connectivity solution providers for developing a network of vehicles for a host of advanced services. In recognition of the high potential of V2X applications, the current focus of government organizations, road transport authorities, automotive companies, transportation entities, city planners, and other stakeholders is to concentrate on the infrastructure requirements that form the backbone of the V2X ecosystem. The industry consensus to achieve zero road accident deaths (~1.35 million people die each year because of road traffic crashes in 2019) is also driving the upgrade of existing safety solutions by leveraging smart V2X infrastructure.

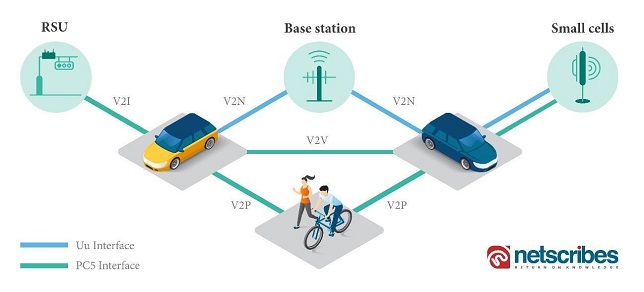

The meaning of connected vehicles has consistently evolved over the years, especially in the last decade. Initially, basic in-vehicle or wireless connectivity provision, infotainment, or imply smartening up of some of the vehicular use cases was considered as a criterion for tagging vehicles as ‘connected’. However, the order of vehicle connectivity is increasingly being defined by the level of cooperation capabilities, consistency, and automation that can be injected by leveraging V2X principles, as shown in Figure 1. The principle V2X terms include – vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), vehicle-to-network (V2N), and vehicle-to-pedestrian (V2P). Furthermore, sensor networks, roadside equipment, telecom networks, mapping and positioning solutions, cloud infrastructure, and other information and communication technologies (ICT) form the pillars of V2X infrastructure.

Over the years, the growing debate around the choice of communication technology between

802.11p and cellular networks have been a global concern. While General Motors and Volkswagen have selected the dedicated short-range communication (DSRC) protocol and are advancing with their plans for DSRC-capable vehicles, a significant section of automakers are betting on cellular V2X (C-V2X) capabilities. Furthermore, for C-V2X, the future deployment scenarios will be dependent on how the complementary capabilities of side-link (PC5) and cellular interface (Uu) are utilized for suiting application requirements.

In any case, the need for a comprehensive communication infrastructure is inducing participation in exploring options that could help unlock the true potential of V2X, regardless of technology preferences. The different stakeholders are assessing potential business models utilizing DSRC and C-V2X technologies. Infrastructure operators including transportation departments and road operators can deploy DSRC units or build relationships with mobile network operators (MNOs) for leveraging cellular networks in disseminating connected car information.

As V2X gradually gains traction, OEMs gear up to control the in-vehicle touchpoints by establishing a relationship with telecom providers and road operators who will ultimately interact with the end-user. The natural evolution of this relationship is with the road infrastructure player taking over the responsibility of providing connectivity, acting as a tenant to the MNOs.

– Siddharth Jaiswal

The present roadmap for 5G-V2X communication has the potential to spur the deployment of automotive applications, a longstanding battle that has divided the automotive industry. An autonomous vehicle is one such revolutionary example that promises a roadmap for success with the highest-profile efforts for scoring greater levels of autonomy. However, autonomous vehicles cannot achieve their true potential without achieving 360-degree and non-line-of-sight (NLOS) visibility, both of which help ensure safety and efficiency. Only V2X communication can help bridge this gap.

Infrastructure development – Global V2X trials

An assessment of global V2X trials with a focus on the connectivity base (i.e., roadside infrastructure and network equipment) indicates the initiatives undertaken by different entities. These trials are focused on different aspects of the infrastructure including installation of RSUs, exploration of PC5/Uu for C-V2X, urban and rural deployments, interoperability, and harmonization of systems under C-ITS. The assessment highlights a continuous increase in trials and pilot projects undertaken in the V2X domain, indicating a clear sign of soaring demands for connected mobility solutions. The industry is aiming to integrate smart intersections and masts with wireless communication modules in urban and rural areas to optimize communication channels for thousands of vehicles.

The main driver for the surge in trials over the past two years has been the dominance of C-V2X technologies in comparison to DSRC. However, the global COVID-19 pandemic in 2020 has resulted in a slowdown and caused delays in the execution of planned trials, and there may be a major postponement in the installation and commercialization of planned RSUs and small cells targeted for V2X applications. As the COVID-19 curve flattens, it is expected that regional governments and automotive companies will proceed with their impending programs on smart transportation and intelligent safety solutions.

Globally, about 62% of the infrastructure-related trials are for C-V2X technologies and use cases. LTE is a natural choice for deploying C-V2X solutions owing to its maturity, and the coherent planning of 3GPP standardization cycles. Several LTE trials are currently underway with a focus on C-V2X infrastructure to enable a smoother transition to 5G New Radio (NR) with Rel. 15 and Rel. 16.

5G-focused V2X trials are significant in numbers with objectives that are aligned to advanced use cases including teleoperated vehicles, multimodal services (trains, automobiles, etc.), efficient use of mm-Wave spectrum, and effective network slicing solutions. These trials are the first-hand enablers of the know-how that the industry needs for transitioning towards a resilient, long-term roadmap for 5G-enabled connected vehicles.

China: Leading the race for C-V2X trials

Proactive governance is a major reason for China’s leadership in the adoption and maturity of C-V2X technologies. The early standardization of policies and full support by the Ministry of Industry and Information Technology (MIIT), Ministry of Transport (MOT), and the Standardization Administration of China (SAC) permitted Chinese automakers, OEMs, chipset providers, and telecom companies to innovate, research, and develop beyond the short-range communication technologies, even as early as in 2016. Later, in 2018, MIT’s allocation of 20MHz spectrum (5905-5925MHz) for LTE C-V2X was motivated by the Internet of Vehicles (IoV) initiative that became a major driver for accelerating LTE based trials and demonstrations across the country. LTE-V2X has been a roadmap for the major local companies including SAIC Motors, Huawei, Datang, Autotalks, China Mobile, and China Unicom, resulting in the establishment of multiple testing sites and zones. China initially started testing on a campus and city level, and later expanded it to the highway and cross-border trials in 2018.

Europe: Previously undecided on standards; upbeat with future endeavors

Europe has been evaluating competition for DSRC and cellular technologies since 2015. By early 2019, the European Commission (EC) announced the 802.11p standard as the central communication technology for V2X applications. This unexpected announcement regarding the support for 802.11p mode became a major concern for telecom companies, automakers, chip manufacturers, and other stakeholders who were favoring C-V2X technology. In July 2019, the EC reversed its decision to make the 802.11p standard the go-to technology for V2X indicating the promise of C-V2X in Europe.

Due to these uncertainties in European standards regularization, the trials related to DSRC hardly scaled up, resulting in a rise in the testing of dual-mode operation with both 802.11p and C-V2X. The dual-mode operation-based trials in Europe account for 30% of the total trials in the region, which is more than in any other geography. A majority of the remaining European trial efforts are dedicated to C-V2X. Several telecom companies, including Vodafone, Deutsche Telecom, Ericsson, Nokia, and Telefonica, have participated in C-V2X trials with a focus to adapt to the requirements of the 5G networks in the future. Additionally, multiple European projects under C-ITS are also exploring cross-border use cases based on 4G and 5G networks, with a prime focus on interoperability and backward compatibility.

The USA: DSRC trials prevalent; shifting gears for C-V2X

In the US, trials that started before 2014 were DSRC tests led by USDOT or state-based transportation departments. These trials are primarily focused on ITS applications with basic enablement for V2V communication and electronic tolling-like services. After the release of C-V2X standards in 2017, the trial activities were divided into either DSRC or C-V2X with a small number of trials focused on dual-mode scenarios. Although the USA will not drop DSRC or dual-mode support immediately, the pattern of trials and government policies highlight the country’s focus on pushing a single standard for the future of V2X communication.

Conclusion: Impact of V2X on infrastructure evolution

Near-term Impact: The industry’s efforts to advance RSU deployment and to integrate it with cellular infrastructure are culminating in the exploration of virtual RSUs. Integration of cloud and core networks in the next few years will pave a path for cloud vendors to directly cater to the V2X ecosystem.

Mid-term Impact: The direct implication of the evolution of the infrastructure for V2X applications will be evident in the smartphone industry. The chipset providers will initially explore the development of DSRC capabilities for mobile phones and then eventually research at a later stage on the integration of PC5 for smartphones, thus transitioning existing smartphones into C-V2X-enabled smartphones. This model will also extend the likelihood to venture into new V2P use cases.

Long-term Impact: The C-V2X ecosystem provides the automotive decision-makers and the different stakeholders an opportunity to envision “car as a network”. Currently, the C-V2X technology is being rolled out leveraging the existing cellular networks. However, with the adoption of V2X capabilities, vehicles can transform into a moving network or data center. In futuristic terms, vehicles can themselves perform the functionalities of a small cell by providing coverage for consumer as well as enterprise use cases. This trend is inevitable with the infrastructure evolution: from RSU to small cell to the core network and then, to the cloud.

Authors:

Siddharth Jaiswal

Practice Head – Automotive

Netscribes

Siddharth has been tracking the automotive industry for the past nine years with a keen interest in the future of mobility, autonomous technology, and vehicle E/E architecture. He leads the automotive practice at Netscribes and works closely with the major automotive companies in solving some of the most complex business challenges.

Faizal Shaikh

Manager – Innovation Research

Netscribes

Faizal has six years of experience in delivering digital transformation studies that include emerging technology domains, disruptive trends, and niche growth areas for businesses. Some of his key areas of interest include AI, IoT, 5G, AR/VR, infrastructure technologies, and autonomous/connected vehicles.

Published in Telematics Wire