Need for restructuring the E/E architecture with the rise in ACES mobility

The world is witnessing a major transformation in the mobility industry, at faster pace than ever. Vehicles are on the verge of taking full control and reliving drivers off their duties. More connected, highly autonomous, fully electric features are what OEMs are endeavoring to offer in the passenger cars with an aim to position themselves among the top automotive innovators. Moreover, opening opportunities in the ACES (autonomous, connected, electric, and shared) mobility has disrupted the entire automotive value chain, thereby revolutionizing the business models of majority stakeholders.

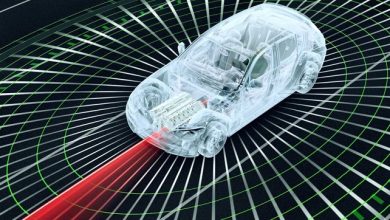

Perception of environment is the basis for vehicles to drive autonomously and ensure high level safety. As the industry moves toward increasing functionalities and features, vehicles tend to become more complex structures. Sensors and advanced control units with a perfect blend of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is enabling the carmakers to achieve the desired level of technology breakthroughs in today’s automobiles. This is changing the entire topology of vehicle systems and electrical/electronic vehicle system architecture (E/E Architecture) is the prime element.

ADAS and Evolution of E/E architecture

Advance Driver Assistance System (ADAS) functionalities are no longer restricted to just the vehicle safety, but also to the certain level of autonomy. As the industry progresses towards deploying higher level of autonomy features, it is prerequisite to add advanced sensor systems, higher computing power, and complex architectures. Sensors such as 4D radars and LiDARs involve high perception computing and large data processing. The next-generation vehicles are expected to generate 5-20 TB data by next decade. V2X and autonomous vehicles are also responsible for creating a shift in data transfer protocols. Design and deployment of these systems certainly is a complex task and requires advance control units and refined architectures that could accommodate the increasing data throughputs. And identifying and re-structuring the E/E architecture is the impending challenge for the tech players.

Not only the advanced driver assistance system (ADAS), but every connected, telematics, and electric feature constitute to the electrical wiring and electronic components of vehicles. The cost associated with these technologies and stringent time-to-market further adds pressure on OEMs, tier-1s and system integrators. The technology players are modernizing their solutions and trying to serve the industry by developing customer-specific E/E architectures that ensures the inclusivity of all the functional architectures. However, there is a need for a uniform architecture that balances all interdependent requirements and design that serves all the modern vehicle technologies along with higher level of autonomy functions.

The E/E architecture traditionally used in the vehicles was distributed type and has evolved to domain centralized. With the increasing ADAS features, OEMs have realized the need to shift from distributed E/E architectures to domain controlled, where the data generated from multiple sensors could be processed simultaneously. Tesla is the notable example for implementing domain control architecture for its Autopilot system. All the complex autopilot functionalities and the software updates are enabled to perform seamlessly through this type of architecture.

However, with the further innovative feature additions, it is expected that the E/E architecture will evolve in zonal ECUs with server-based architecture. The Zonal ECUs are designed to connect the sensors and actuators data to the centralized vehicle servers, thereby reducing the wiring complexity. Moreover, the safety critical applications such as Emergency braking and Air bag control system are expected to perform real-time in zonal ECU architecture.

The centralized architecture is expected to become the predominant vehicle architecture as it significantly reduces the number of wires and increases the overall computing power of the vehicle. This will also assist OEMs in controlling manufacturing costs and increase the flexibility to add more software features to enhance the AV capabilities. The Zonal ECU with centralized computing is expected to be the most sophisticated E/E network architecture and perform seamlessly and independently. However, implementation of zonal ECUs with centralized E/E architecture will create a disruption in the supplier ecosystem.

Impact on Supplier Ecosystem

The emergence of software segment in the vehicle and its progression towards overtaking the hardware segment is creating a change in the automotive supply chain. The dependence on software has opened the path for software companies to climb up in the supply chain. The new entrant and other software firms have joined tier-2 companies to serve directly to the tier-1s and OEMs. Acquisition of software companies and start-ups is the major strategy being followed by tier-1s to stay ahead in the race.

As the industry will adopt centralized E/E architecture, the OEMs will require to consolidate software platforms in vehicle hardware. And the future expected implementation of 5G and Artificial Intelligence (AI) will further increase the dependency of OEMs on the software players. In this scenario, OEMs are expected to work closely with specialized software providers for defining a platform for every vehicle model. This will create a vendor lock-in situation and supplier switching would become an expensive and non-credible choice. The major challenge that the OEMs will face is limited flexibility and compromises.

OEMs are required to take few strategic considerations to deal with the changing supplier ecosystem. Automakers are involving in strengthening their in-house software capabilities and developing full-stack competencies. This is being done either by talent acquisition, investment in software development companies, or acquiring business units. Also, OEMs are speeding up the time-to-market for new E/E/ architecture solution by centralizing the Software and E/E architecture departments.

Tier-1s are increasing their capabilities in E/E architecture and software market by jointly working with OEMs to define new E/E architectural structures. Few of the tier-1s including Veoneer, Continental, and Bosch are investing in software capabilities and creating a dedicated development, integration, and validation tool chain to enable continuous integration and development.

Component suppliers are taking steps towards developing specialized software capabilities to ensure the fulfillment of OEM requirements. Few of the tier-2s are even successful in by-passing tier-1s and directly partnering with OEMs.

This sift from vertical tiers to horizontal collaboration with suppliers is the one of the notable disruptions in the automotive industry, today.

The ADAS & AV software and E/E architecture industry is holding a potential of $500 billion market by the end of this decade

The industry is facing magnitude of change with the emergence of Autonomous Connected, Electric and Shared (ACES) mobility. Advancement in technology have enabled a major shift in consumer behaviours, innovative business models, change in supplier ecosystem, and rise of start-ups within the mobility space. Software including AI and ML have played significant role in driving this market.

As software in vehicles is becoming prominent, most of the advanced functionalities are expected to be enabled through software. The mobility industry is witnessing a shift of trend towards on-demand services. Connected features, telematics, infotainment will no longer be a part of hardware systems in the vehicles, over-the air updates will be more frequent. Also, the architecture is expected to be more scalable and sustainable, giving rise of Service -Oriented-Architecture (SOA) which can be used across all the vehicle classes, applications, and ADAS features.

Since, software and E/E architecture remains the biggest focus area for all the leading automotive players, the industry has witnessed some of the largest M&As and partnerships in the software and E/E market space during last two years which recorded an aggregated capital flow of whooping $100 billion.

Moreover, the time-to-market of Autonomous Vehicles (AVs) on public roads is much closer than anticipated. China, the U.S., Singapore, and other Western European countries have unveiled public operations of robotaxis and autonomous last-mile delivery vehicles (in specific ODDs). This is driving the tech players to speed up the development and implantation of advanced software and design scalable architectures that can execute the complex operations of AVs.

The breakout of COVID-19 pandemic though has dented the growth of conventional automotive industry, the software and E/E architecture market had an insignificant impact. This sector is anticipated to show a market growth of 8 percent by 2030. The ECUs/DCUs accounts for largest market share and expected to grow at moderate rate. This is because the price erosion is expected to have counteracting effect on the rising sales of ECUs/DCUs in the ADAS and autonomous driving application. Rising adoption of Electric Vehicles (EVs) has driven the surge in the growth of power electronics market.

The ADAS and AV software market is majorly attributed to the industry’s focus on developing computer vision, AI, and Machine Learning (AL) algorithms along with cyber security. The only software industry is expected to witness over 12 percent CAGR by next decade.

The ADAS software and E/E market growth differs with the change in level of autonomy and electrification. For example, the electronic content and software algorithms are largely different in level 1 vehicle than that in higher level of autonomy. Also, the system differs with different powertrains such as ICE, BEV, PHEV, etc. Thus, the growing demand for AD systems, and electric powertrains will drive the market growth of software and electronics and open opportunities for companies in this space.

The competition in the market is aggressive and companies including Veoneer, Continental Engineering Services, Aptiv, Elektrobit, Siemens Digital Industries Software, Bosch Mobility Solutions are among the top players. OEMs and Tier 1s are repositioning their strategies as they are currently not equipped with the software talent. The major focus of these players is on co-developing the technology with new tech entrants either by partnership or acquisition. OEMs and Tier-1s are combining their resources to re-structure the E/E architecture and find a solution that better fits for today and scalable for future innovations. However, this change in the strategic developments amongst the industry players has created a ripple effect down the entire supply chain.

All the stakeholders in the ACES ecosystem are embracing the strategy of working collaboratively to re-structure and redefine the E/E architecture capabilities that will allow a level of sustainability in this disruptive industry and sharply reduce the time-to-market for truly autonomous vehicles.

Author:

Pradnya Nanir

Principal Consultant – ACES Mobility

M14 Intelligence

Pradnya is a technology strategist with years of experience as technology consultant in niche markets of Aerospace, Defense, and Automotive industry. Being one of the founding members at M14 Intelligence, she is contributing towards developing high-growth research practices and strategies so as to enable clients to accelerate growth and position in the emerging tech industries. M14 Intelligence is an emerging automotive technology research and consulting company focused on providing strategic consultation to leading companies dealing in ACES (autonomous, connected, electric and shared) mobility markets. Company’s exhaustive, extensive, and comprehensive research capabilities help companies foresight the market potential, plan and prepare for the future.

Published in Telematics Wire