Enabling Safety & Connectivity with next generation ADAS

Advance Driver Assistance Systems (ADAS) help automotive ecosystem partners reach zero - accident mobility while improving connectivity

Autonomous driving with improved safety features is one of the most ambitious areas of automotive innovation. The ever increasing number of road accidents is a point of concern worldwide. The situation in India is no different. According to a report published by the World Bank, India, with just one percent of the global vehicle population, accounts for eleven percent of worldwide deaths in road accidents – the highest in the world. About 4.5 lakh road crashes happen in India per annum, leading to 1.5 lakh deaths.

Considering the seriousness of the problem, automotive OEMs worldwide are focused on zero-accident mobility. Consequently, vehicle safety systems are evolving, paved by the convergence of Advanced Driver Assistance Systems (ADAS) and telematics creating adaptable systems which ensure a safer, more automated driving experience. ADAS, or advanced driver-assistance systems, are sensor based intelligent systems that have the potential of dramatically improving road safety paving the way for zero-accident mobility. ADAS includes various types of sensor technologies, optical technologies and radar to LiDAR (light detection and ranging), operating in tandem with powerful artificial intelligence (AI) software.

How ADAS work

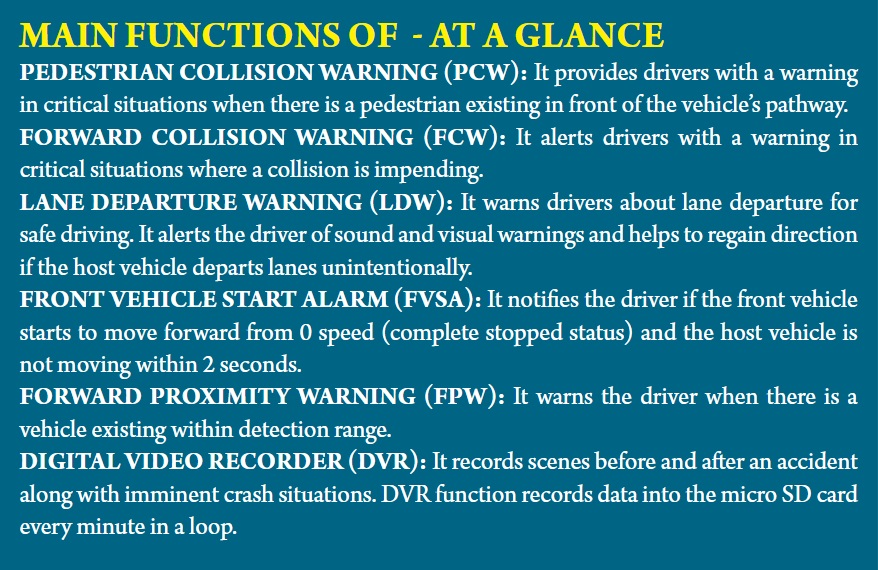

Advanced Driver Assistance Systems (ADAS) assists drivers by offering advanced technological solutions, such as Adaptive Cruise Control (ACC), Intelligent Speed Adaptation (ISA) or Collision Warning Systems (CWS). A safe Human–Machine Interface (HMI) is also considered while designing these driver assistance systems. ADAS can share vital information about road closure, congestion levels, and alternative routes to avoid congestions. These systems are even capable enough to judge the fatigue and distraction level of the driver and provide precautionary alerts. On assessing potential threats, these systems take over complete control from the human driver and execute easy safety tasks like cruise control as well as difficult maneuvers such as overtaking and parking. Some ADAS systems, classified as ‘active safety systems’ or ‘dead driver systems’, operate in an even more advanced way. Obstacle detection systems for example can decide to brake, if the situation is assessed as ‘very dangerous’.

Different components of ADAS enable different safety features. For example, Lane Departure Warning (LDW) continuously monitors lane driving and alerts the driver to any deviation with the help of a variety of alarm options like audible alarm, lights, HUD display, vibration etc. This in turn enables drivers to take corrective action. Whereas, Blind Spot Detection (BSD) is a radar sensor based ADAS component which monitors a vehicle’s blind spot, a driving zone hidden from the driver’s field of vision. Blind spots cause a large number of road accidents. Another important safety component, Forward Collision Warning (FCW) detects potential collision situations with a preceding vehicle in the vehicle’s lane. These three useful driver assists create the “circle of safety” by protecting the vehicle to the front (through FCW), side (through LDW), and rear side (through BSD).

In ADAS, possibilities for time-to-collision (TTC) and headway are computed and if they cross the safe threshold, suitable alarms are set off to alert the driver. Pedestrian Detection System (PDS) coupled with zero user setup automatically detects people walking in front of the car. It helps drivers avoid collisions.

Benefits demystified

Implementation of ADAS results in numerous benefits. However, the most important advantage of using ADAS is that they facilitate communication between different vehicles. This enables exchange of information for improved vision, localization, planning and better decision making capacity of the vehicles.

Besides improving driver performance and vehicle safety, these systems also reduce costs associated with vehicle collisions such as disbursements for third party injury or damage, repair and replacement of expensive accessories or components.

Moreover, insurance companies have been especially receptive to working with ADAS technology for a couple of main reasons. First, ADAS offers an all-in-one solution including headway monitoring and warning to prevent tailgating, forward collision warning, lane departure warning, pedestrian and cyclist collision warning and speed limit indicator. Second, the technology can easily be retrofitted into existing vehicles at the fraction of a cost of purchasing new vehicles. By offering customers discounts for installing collision avoidance systems, insurers can both lower their premiums and their clients’ risk of collision. Insurers that take advantage of this opportunity will surely gain a significant competitive edge over the next few years.

Although these systems are primarily designed to provide real-time feedback to the driver to improve driver performance, by connecting the ADAS to a telematics system, it is possible to implement a driver monitoring program by capturing the vehicle activities within a fleet system. Moreover, the captured data can be used to create key performance indicators (KPI’s) for tracking timely performance for a specific driver, or from driver to driver during a specific timeframe.

An interesting case study is shared below explaining the application of ADAS for a leading e-Commerce fleet management.

Case Study : Enabling fleet management for a leading eCommerce player through ADAS

A critical event analysis of ADAS & DMS /1000 KM basis was done with five vendors (109 fleets) of the e-Commerce player. SerVision (India) installed (Table 1) ADAS in September, 2021 and provided critical trend analysis on a weekly basis.

| SN | Vendors | Total Installations | Accidents per Trip% |

| 1 | Vendor 1 | 23 | 0% |

| 2 | Vendors 2 | 28 | 0% |

| 3 | Vendors 3 | 32 | 0% |

| 4 | Vendors 4 | 26 | 0% |

The company conducted a survey with select vendors, analyzing the most accident prone routes and 32 feet line haul vehicles which ply on national lanes and highways. Those were also rated as the low performing carriers in their fleet.

The benchmark analysis of the following three critical events were on 3 parameters:

- Forward Collision Warning

- Drowsiness

- Distraction/Phone calls

ADAS & DMS Warning Trend Analysis Reports

Benefits realized

- No accident happened in the 100 plus fleets where ADAS were installed.

- The Weekly trend analysis reports enable the eCommerce player to assess and compare performance of the vendors, vehicles and drivers. The eCommerce player intends to set up benchmarks for the minimum number of alerts per vendor/vehicle/driver.

- ADAS systems enable drivers to follow appropriate driving behaviour through sound based training .

Market need for ADAS

Advanced Driver Assistance Systems (ADAS) have helped improve road safety by complementing the drivers’ actions. Till date these systems are only available on new luxury vehicles. However, there is a strong market demand for making these features available for even mid level vehicles. According to a report published by Markets & Markets, the Global ADAS Market size is projected to grow from USD 27.2 billion in 2021 to USD 74.9 billion by 2030, at a CAGR of 11.9%. Compliance with upcoming safety mandates and increasing demand for semi-autonomous driving systems will drive the market for ADAS.

Impact of COVID-19 on ADAS Market

The COVID-19 pandemic has led to the suspension of vehicle production and supply disruptions, which have brought the automotive industry to a halt. Lower vehicle sales will be a major concern for automotive OEMs for the next few quarters. In 2021, lower vehicle sales and abrupt stoppage in the development of new automotive technologies resulted in sluggish growth of the advanced driver assistance systems market. The ADAS market, however, is expected to witness a significant boost in 2022 owing to the mandates by different countries.

The Asia Pacific ADAS market is expected to emerge as the largest shareholder by 2030. This expected growth in this region can be attributed to the high vehicle production. Several developing countries in this region like China, Japan, Korea have recognized the growth potential of the automotive industry and have consequently taken various initiatives to invite major OEMs to their domestic markets. As a result, several European and American automobile manufacturers such as Volkswagen (Germany), Mercedes Benz (Germany), and General Motors (US) have shifted their production plants to those countries.

Major ADAS solution providers such as Robert Bosch (Germany), Continental (Germany), and Denso (Japan) have production facilities across the region as well.

Despite the slowdown in vehicle sales due to the COVID-19 pandemic, evolving safety mandates is likely to boost the penetration of ADAS features in upcoming vehicles. For example, China is considering mandating automatic emergency braking during the forecast period. In addition, the Chinese government released multiple measures to boost economic recovery, including stabilizing domestic consumption, supporting new energy vehicle development, and other monetary and fiscal policies. Economic assistance, upcoming mandates, and the growth of Chinese OEMs is likely to drive the demand for ADAS in the country.

The Ministry for Road Transport and Highways (India) planned to adopt ADAS features by 2022. Features such as electronic stability control and automatic emergency braking have been considered in the first phase. Tier 1 manufacturers such as Continental are collaborating with OEMs in India to support the implementation by 2022-2023.

ADAS Market dynamics

- Driver: Stringent vehicle safety regulations: Increasing awareness about vehicle safety ratings and decreasing component costs due to extensive application of cameras and radars are major growth drivers for the ADAS market. Major OEMs are implementing ADAS solutions to accomplish higher safety ratings and attract more consumers. Hence, they either incorporate standardized safety systems across models or offer these systems as additional features. The increasing penetration of advanced driver assistance systems features will surge the demand for components such as cameras, radar sensors, ultrasonic sensors, and LiDAR during the forecast period.

- Restraint: Lack of required infrastructure in developing countries: ADAS requires basic infrastructure to be in place such as well-organized roads, lane marking, and availability of GPS for effective functioning. Poor infrastructure outside urban areas, cost considerations, and poor driving training or driving discipline restrain the growth of the ADAS market in developing countries. In addition, the financial crises due to the ongoing COVID-19 pandemic will further delay the development of modern infrastructure for intelligent transportation.

- Opportunity: Launch of autonomous vehicles: The introduction of autonomous vehicles is expected to transform commuting. ADAS technologies have significantly reduced the complexity of driving, with features such as lane monitoring, emergency braking, stability controls, and others. Autonomous vehicles rely on advanced technologies and systems such as LiDAR, radar, ultrasonic sensors, and high-definition cameras to collect data. This data is analyzed by an onboard smart autonomous driving system to maneuver the vehicle safely. The increasing focus on autonomous driving systems would lead OEMs to incorporate more cruise control features and advanced safety systems even for semi-autonomous vehicles.

- Challenge: Environmental constraints and security threats: Majority safety features of ADAS constitutes sensors such as radar sensors, LiDAR, ultrasonic sensors, cameras, infrared, and several actuators. These sensors and actuators monitor fields in every direction and ensure the safety of the vehicle, driver, passengers, and pedestrians. The functioning of the system depends on several factors, such as traffic and weather. Lack of accurate fail safe methods could jeopardize occupant safety. A perfect balance between automation and manual override is necessary for the safe operation of advanced driver assistance systems. In addition to its functional requirements, ADAS must be secured from hackers with malicious intent. A hacker who infiltrates the system could gain control of the vehicle. Several studies have shown that vehicle control can be gained through Bluetooth, Wi-Fi, or even GPS. These security threats pose a significant challenge for system manufacturers and OEMs.

Moving Forward

The passenger car segment is going to make a major contribution to the ADAS market. The increased demand for safety systems in emerging markets can be attributed to improving road safety standards, supporting legislation, and consumer awareness. Several countries in Europe, North America, and Asia Pacific have introduced regulations that mandate the incorporation of various types of ADAS in the passenger car segment. For instance, the European Union has outlined Vision Zero, an initiative to mitigate road deaths to zero by 2050. The authority has targeted to reduce fatalities and injuries by 50% by 2030. The strategic plan also includes mandating major safety features such as lane departure warning, automatic emergency braking, and drowsiness & attention detection in new vehicles by 2022. Developed countries such as South Korea have mandated AEB and LDW systems for all new passenger vehicles from January 2019.

Author:

Saikat Samanta

CEO

SerVision (India)

Saikat Samanta is a technology practitioner and entrepreneur. Co-founder of an Indo-Israeli venture for technology co-operation and CEO of Servision India, Saikat firmly believes that engineering and innovation must be at the heart of sustainable change and equitable connectedness. He is also an active member of an NGO committed to gender empowerment of young girls and women.

Published in Telematics Wire